Early this year we talked about one truth and three themes:

One Truth: When there isn’t a structural imbalance, real estate follows wealth and employment.

Three Themes:

- Tight supply

- Increasing demand from underlying demographics

- Prices are still high

Where are we now?

The luxury market feels solid, but trendless, best described as experiencing crosscurrents.

Wealth is doing just fine, with equity markets recovering and significant excess savings despite inflation and recession concerns.

Crosscurrent: Affordability is an issue. It costs a lot to own, build or renovate, but materials costs have eased and contractors are not quite as busy. Obviously, borrowing costs are much higher, renting remains a costly alternative with no equity benefit. While $2500 is well below the luxury market threshold, the change in what can be bought for a given mortgage payment is impressive.

The Three Themes

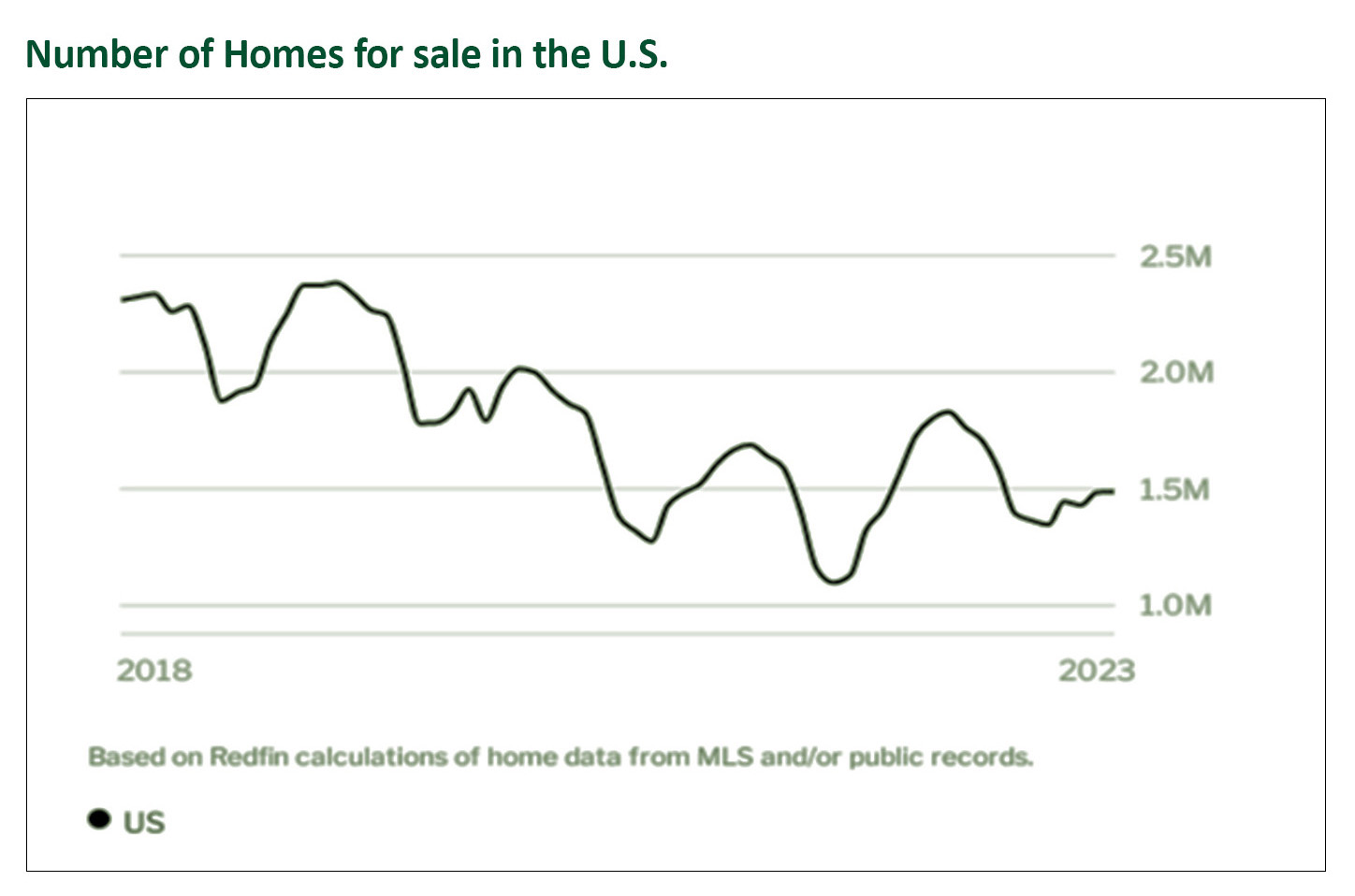

1. HOUSING SUPPLY IS STILL TIGHT

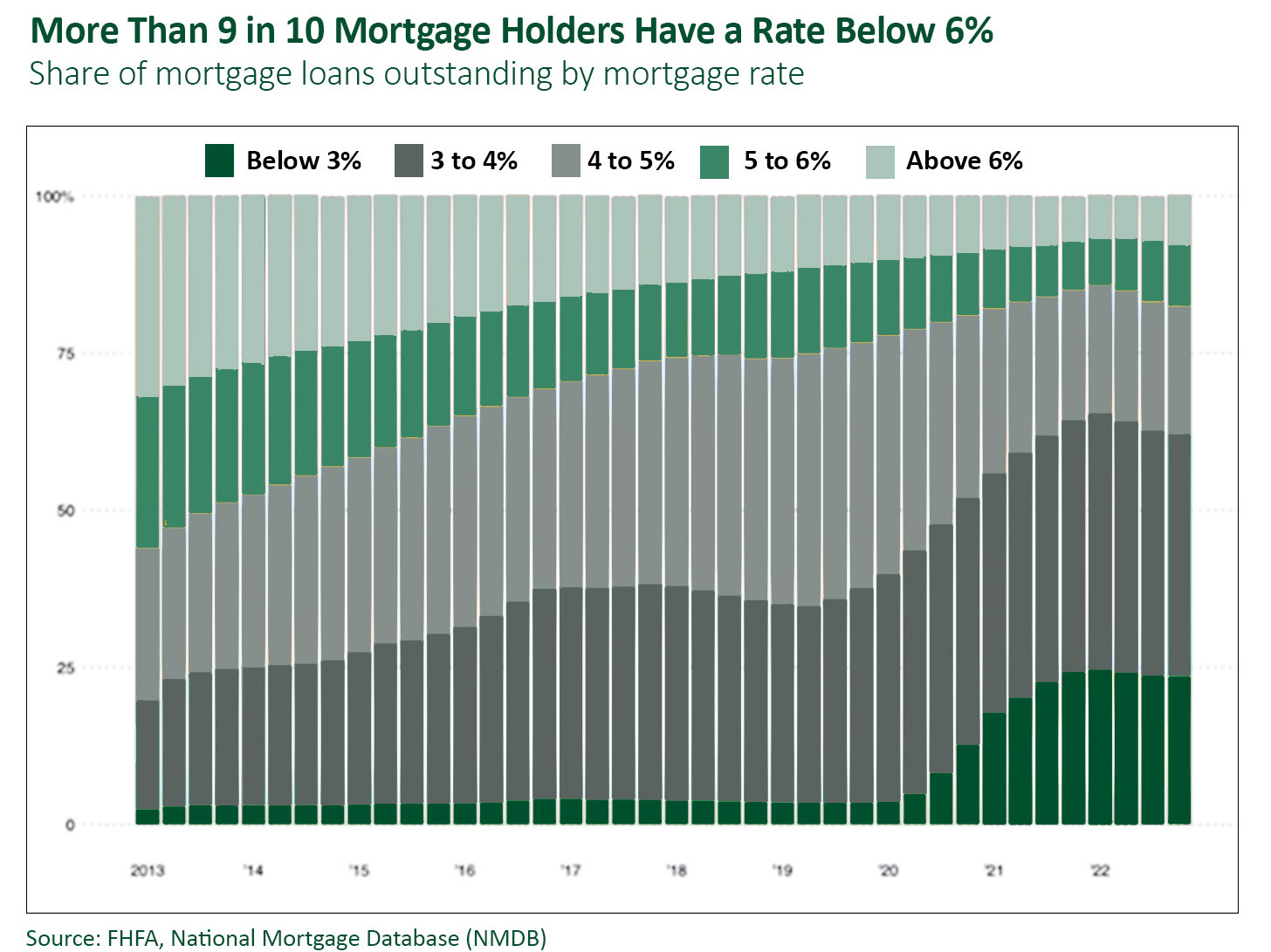

The supply of new homes is low because new construction has lagged demand for more than a decade. Further exacerbating the lack of supply, higher interest rates make it hard for homeowners with low mortgages to move. With current rates around 7%, and 90% of homeowners paying less than 6%, it’s hard to move.

Crosscurrent: Pricing for many properties coming on the market is ambitious to the point of perhaps unrealistic, which makes it hard to put deals together. Price reductions, even big ones, are much more frequent. That said, sales over asking price continue for the great, well-priced properties!

2. DEMOGRAPHIC DEMAND IS STILL STRONG

Millennials, the largest demographic cohort, are forming households as they mature (just like their parents did), creating underlying housing demand. Among the affluent, remote work and a desire for greater quality of life support “co-primary” living: families dividing their time between multiple houses.

Crosscurrent: Return to office and the demands of long commutes to get into the office for a few days a week are prompting some rethinking by property owners returning to locations closer to the office or to more urban areas. New York and Boston are seeing increasing demand for real estate.

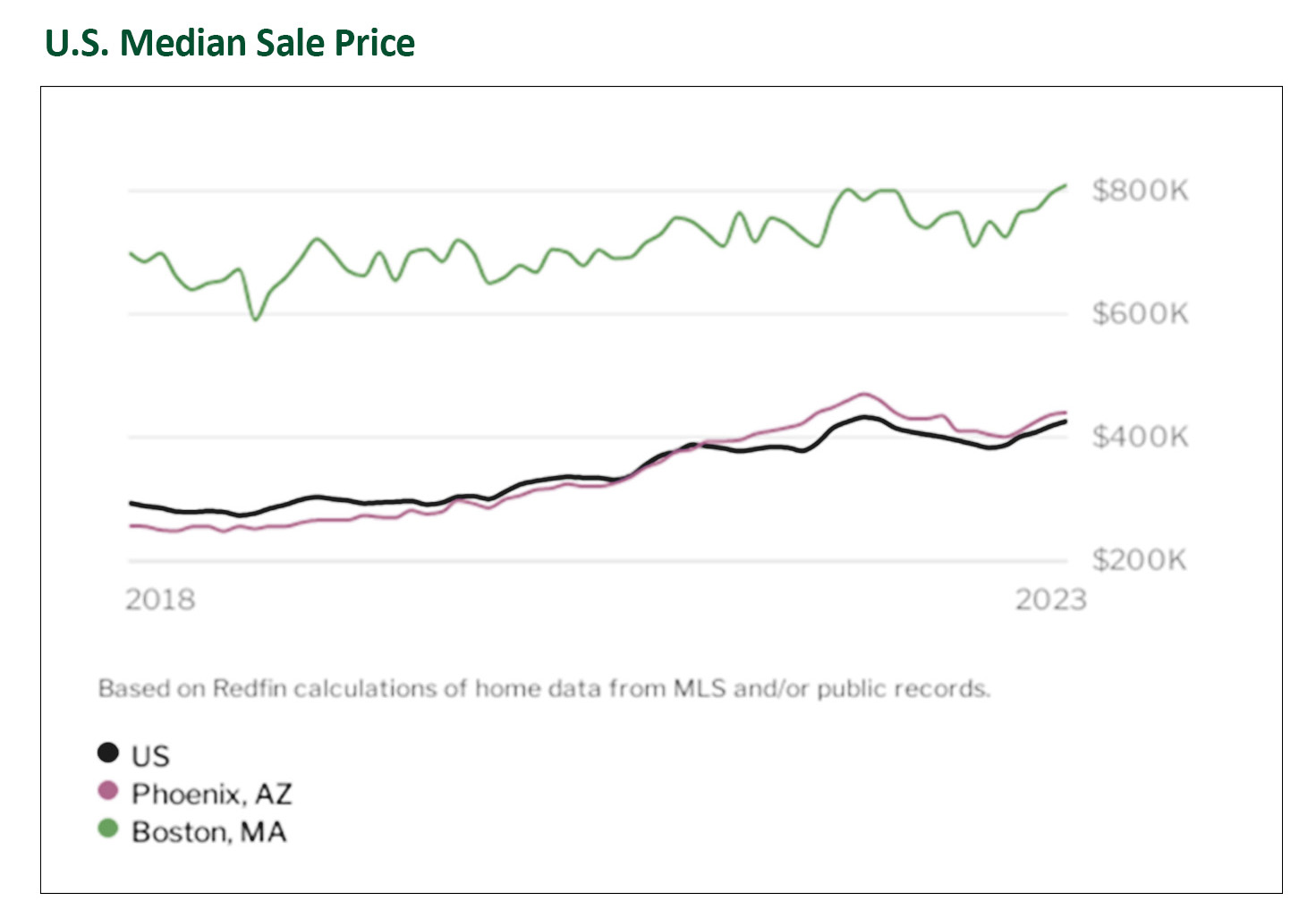

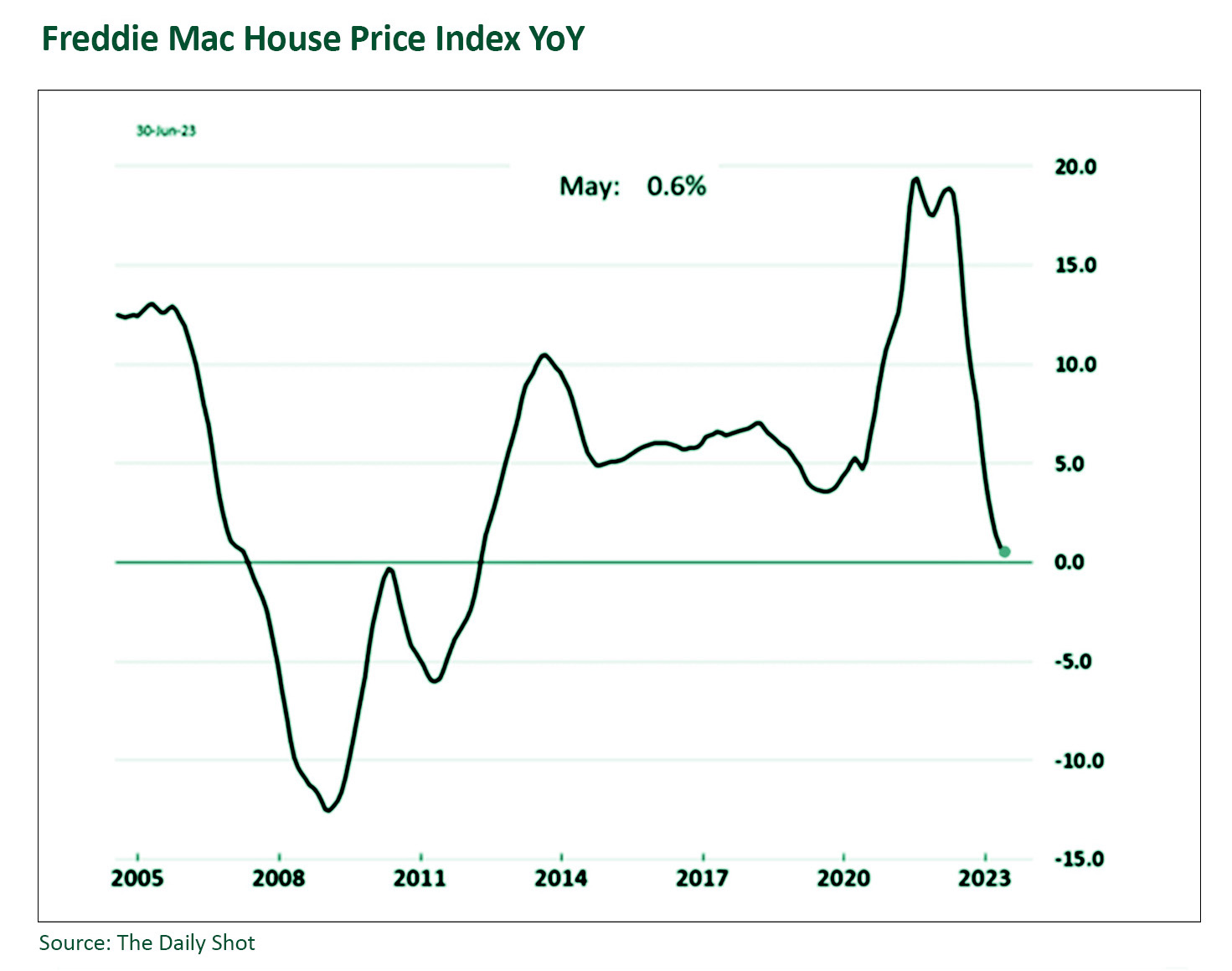

3. PRICING IS STILL HIGH

While in some areas of the US, like Phoenix, pricing is off its highs, in New England, pricing generally remains at peak levels.

Crosscurrent: Price rises have eased nationally. Buyers are a bit more skeptical and there is much less of a sense of a feeding frenzy, though this varies widely by market and price point.

What does this mean?

It’s more important than ever to get expert advice. The market punishes mistakes and it is tough to see property owners who get less than they should for great properties that were positioned poorly. Properties which require significant renovations or investment need adept marketing to overcome the cost and time hurdles.

Property owners are still being very well rewarded when their properties are brought to the market intelligently, properly prepared, and presented.

For buyers? There are opportunities in the market, and well-advised buyers can put deals together that were not obtainable in the midst of the pandemic frenzy. At a minimum, this market gives buyers more time to breathe, consult, and think before acting on a significant purchase.