One Truth: When there isn’t a structural imbalance, real estate follows wealth and employment.

Three Themes:

- Tight supply

- Increasing demand from underlying demographics

- Prices are still high

Is There a Structural Imbalance in Real Estate Currently?

If there is any structural imbalance, it is persistent lack of supply, not speculative oversupply.

Supply of real estate has been tight nationally, but particularly in New England, where new construction has lagged demand since the Great Recession. Permitting is difficult, land is scarce, Nimbys are vocal, well-funded, and organized, and the number of small and mid-sized developers willing to take big risks has never reached the peaks of the late 1980’s.

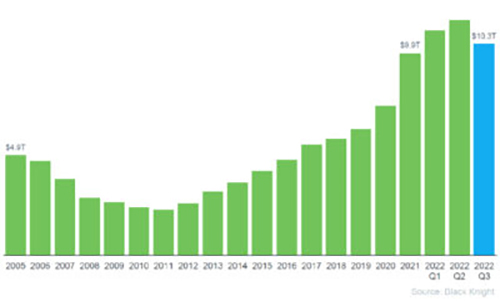

Unlike 2008, most homeowners have positive equity (see chart below). Bank lending has been restrictive. Even through the ebullience of the pandemic real estate market, there isn’t a lot of evidence of speculation in the New England single-family market.

Homeowners Have Ample Equity

Amount of equity available for homeowners to access before hitting a maximum 80% combined LTV in trillions still $400M above last year.

Real Estate Follows Wealth and Employment

Despite the steep decline in tech stocks in particular, wealth and employment are stronger than they were pre-pandemic. We leave it to the economists as to whether the Fed or other events will drive employment and stock market down, but whatever happens, real estate will follow.

Specific to New England, we continue to see strong employment in growth industries such as life sciences, technology, and financial services – all sectors with high salaries and bonus structures. Most New England states have an unemployment rate below the national average of 3.5%.

We are beginning to see consequences of the new Millionaire’s Tax in Massachusetts as buyers turn their gaze north to New Hampshire, where proximity, lifestyle, work from anywhere and tax advantages continue to buoy the New Hampshire real estate market.

Three Themes:

1. Tight supply

Persistent undersupply of housing relative to jobs throughout the metro areas of New England

Historically, there has been one new home built nationally for every two new jobs. In Greater Boston, there is one new home for every 28 jobs. In Burlington, Vermont, it’s one for every 8, and Portland, Maine, one for every 5 new jobs.

Very Tight Housing Markets in New England

Source NAR: Housing Shortage Tracker (nar.realtor)

Despite recent declines in lumber costs, construction costs are high, and contractors are hard to find.

A recent survey by LandVest brokers indicated construction costs ranging from $300 sf as high as $1,500 sf for in-town, waterfront or on-island locations.

It’s tough to leave (a low fixed mortgage): homeowners have to be motivated to give up on a mortgage in the 2% range to buy a new home in the 6% range. Some may find it harder to move. For many, like for any other decision, cost is weighed against quality of life choices and resources.

At the high end of the market, buyers and seller choices are more about “want” rather than “need”.

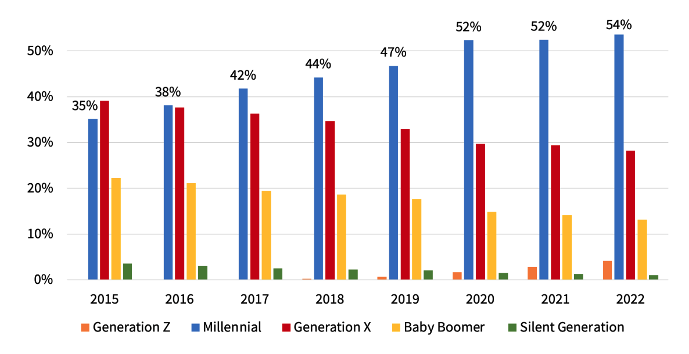

2. Increasing demand from demographics

Milliennials didn’t want to rent or AirBnB forever, as it turned out. The largest demographic cohort in US history now dominates home buying. Like previous generations, as they grow older, millennial demand for primary homes in the suburbs and second homes is increasing.

Source: CoreLogic: Millennial Homebuyers’ Share Continues to Rise in 2022 – Corelogic®

3. Prices are still high

Unless things change, prices are still the highest they have ever been in New England. The only thing they are lower than is some sellers’ expectations.

There is definitely a risk that prices will decline through 2023. The affordability ratio with higher rates and higher prices is not sustainable. Rents, a leading indicator, are starting to decline nationally after a period of very sharp increases. Home price is the variable that’s next quickest to change in response to demand and cost factors.

It’s a good time to think and plan. The lag between appraised and market values may provide planning opportunities to well-advised property owners. Potential and actual tax hikes may be met with agile planning as well. Charitable gifting of real estate interests, particularly with low basis assets which many older property owners have now, can be a powerful tool.