Millennials moving to the ‘burbs and inflection points for the markets

The buzz of the post-Great Recession cycle has been all about hot urban markets at the expense of the suburbs. Here’s our take on the impact of how demographics, structural change, and cyclical factors have driven the urban markets vs. the suburbs and countryside.

We’ve been talking about this for a while.

What’s the latest?

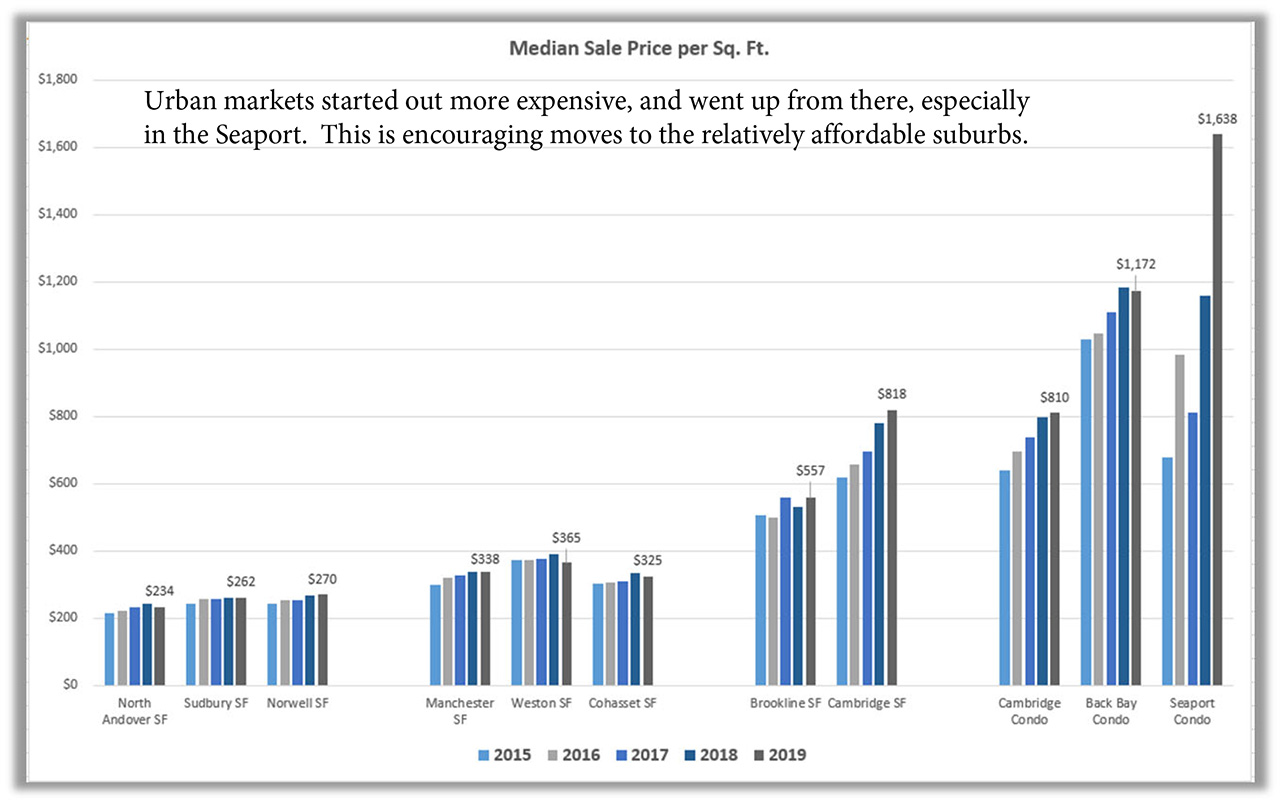

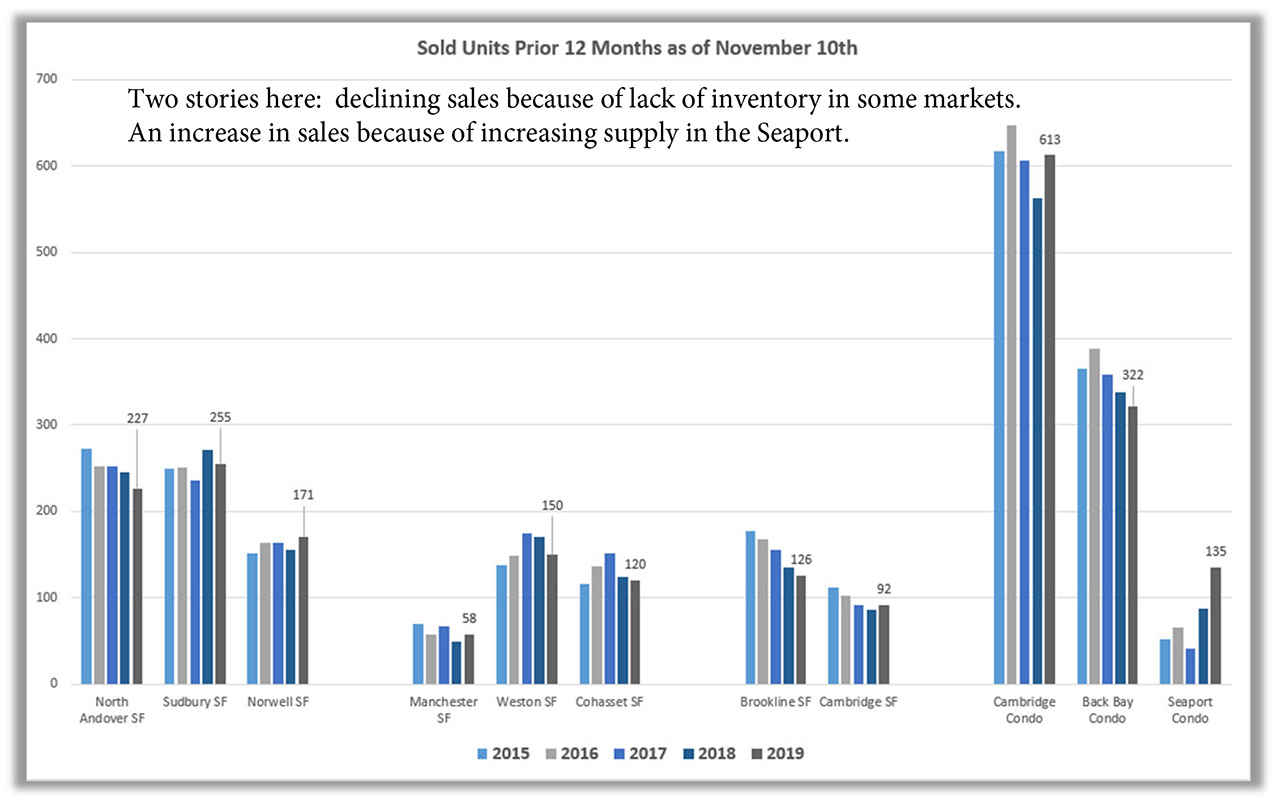

The laws of economics hold: If markets run up enough, new supply will come on, and people will seek more affordable alternatives. The hottest markets are cooling, and the secondary markets are firmer, benefitting from (relative) affordability. New inventory in the Seaport in Boston has made that market a bit less tight. It’s interesting that it takes as long to sell a condo in the Seaport, on average, as it does to sell a house in some of the second-tier suburbs. That’s a first.

Slater Anderson, LandVest’s Managing Director for Real Estate, sampled data from four Greater Boston markets:

- Prime urban condo markets (Cambridge, Back Bay, and the roaring Seaport),

- Prime inner core single-family (Brookline and Cambridge),

- Prime suburban single-family (Manchester, Weston, Cohasset) and

- Second-tier single-family (North Andover, Sudbury, Norwell)

A few quick observations:

Still a tale of two markets: Inner Core Single-Family (SF) & Condo prices are way above prior peak prices. Pricing in prime and second-tier suburban single-family homes have barely topped their pre-Great Recession peak (2005-2008).

As an example, pre-Great Recession, the median sale price for a house in Cohasset was higher than in Cambridge. Now Cambridge is nearly double the Cohasset single-family median price.

However, the tide is turning: Price reductions are up a lot in the Back Bay and Cambridge condo markets, indicating an inflection point for pricing even in the tightest markets. The Prime Suburban SF markets have also seen increases in the number of price changes in 2019.

Increased interest in the suburbs has drawn down inventory in the second-tier markets. Supply of properties for sale is up slightly in the prime suburban markets, and up most in the urban condo markets.

The story around sales volumes are mixed: some markets like Brookline and Cambridge single-family, are slower because there is very limited good inventory. (It’s interesting to see that in Brookline and Cambridge, single-family sales are down, days on market are up slightly – partially a circular function (when sales fall with tight inventory, days on market go up). List price changes in those tight markets are still very low. So, if it’s good, it sells quickly, because there is so little competition.

The story around sales volumes are mixed: some markets like Brookline and Cambridge single-family, are slower because there is very limited good inventory. (It’s interesting to see that in Brookline and Cambridge, single-family sales are down, days on market are up slightly – partially a circular function (when sales fall with tight inventory, days on market go up). List price changes in those tight markets are still very low. So, if it’s good, it sells quickly, because there is so little competition.

Prices run up enough, and people will move out of town. And maybe, some of them want a dog and a yard…

Prices run up enough, and people will move out of town. And maybe, some of them want a dog and a yard…

Want to know more? Reach out to Slater or to me and we can connect you with our teams throughout the Greater Boston market.