Last quarter we addressed the crosscurrents in the real estate market: tight inventory, sellers frozen in place by their existing low mortgages, buyers still searching for the life they want, millennials continuing to come into the market.

Now the tide is turning: The high water of the COVID-era seller’s market is retreating. The ebb tide is leaving fewer buyers in the waters and sellers more exposed to navigational risks.

That’ll do for the nautical metaphors.

Recalling the tenet: in the absence of external shocks, the high-end real estate market follows wealth, this shift from a seller’s market to a buyer’s market makes sense.

- Rates have spiked toward 8%, financial assets have not been rewarding except for select tech companies.

- Add political turmoil here and abroad, the environment is less confident than it has been for several years.

- Across six states that LandVest serves for residential brokerage, there was not much of a Fall rebound in buyer demand.

This is not to say the market is “bad.” It’s more like it’s “fine.” Pricing is still high. Buyers are increasingly cautious on price and terms.

Construction costs are high and contractors are busy, work will cost more and take longer — on top of the opportunity cost of cash earning 5 percent ($100,000 a year on $2,000,000 tends to get people’s attention) or borrowing at 8 percent.

What does this mean for our clients?

It’s all about price. It’s been a while since adept pricing matters like it does now. Market participants are struggling to adjust to the changing tides. Getting pricing right makes a huge difference in long term return for both buyers and sellers. We can help.

We are advising sellers to do the smart stuff before going on the market. Painting, refinishing floors, title clean up, removing underground tanks, pre-sale inspections, and staging where it matters. Eliminate risk for buyers and reduce their leverage.

There are increasing numbers of sellers, so the well-advised win.

LandVest’s proprietary tracking shows an increase in seller activity and a simultaneous drop in buyer activity.

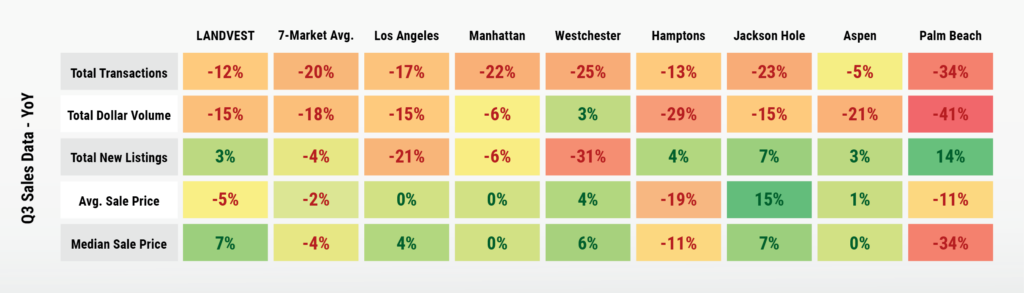

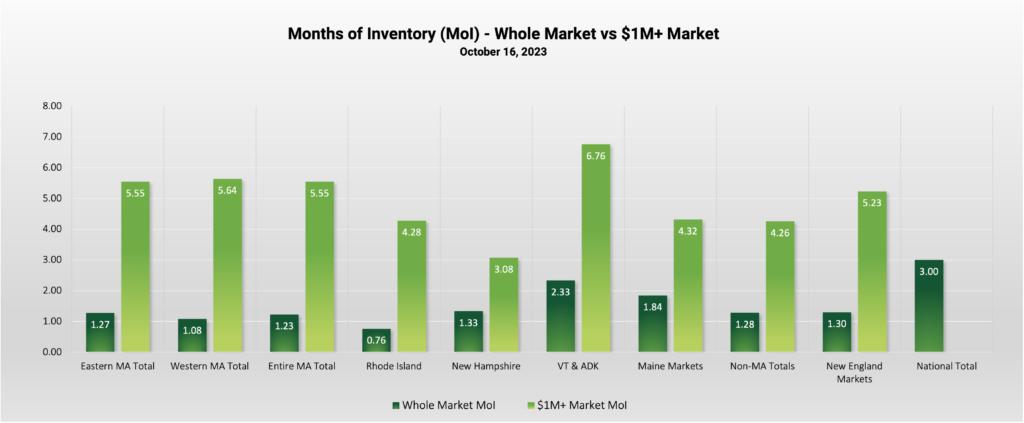

Buyers can afford to be selective because they face less competition. The Fed is getting their way. Looking at the numbers, New England luxury unit sales and volume are down about 25% versus last year. Pricing is probably off its peak from earlier this year, basically flat year-on-year. Absolute levels are still high, especially relative to pre-COVID. This is in line with select luxury markets nationally.

Inventories are up across our regions at the upper end of the market versus the overall market. The market is shifting from a seller’s market to a buyer’s market.

Good advice and advance planning matters more than ever. We are here to help.