Market Insights

The Woodstock area is perhaps the most valuable second home market in New England not on the water or slopeside. Beautiful farms, quiet gravel roads, and rolling countryside have been the perfect antidote to hectic urban life since the Rockefellers started buying up and preserving land in Woodstock in the 19th century.

LandVest’s focus on great properties and global marketing supports our dominance of the Vermont market for sales in the luxury market above $1m.

Gross sales volumes fell 21% in the Woodstock area, a function of tightening supply of great properties on the market. There is a pool of active LandVest buyers looking for special properties.

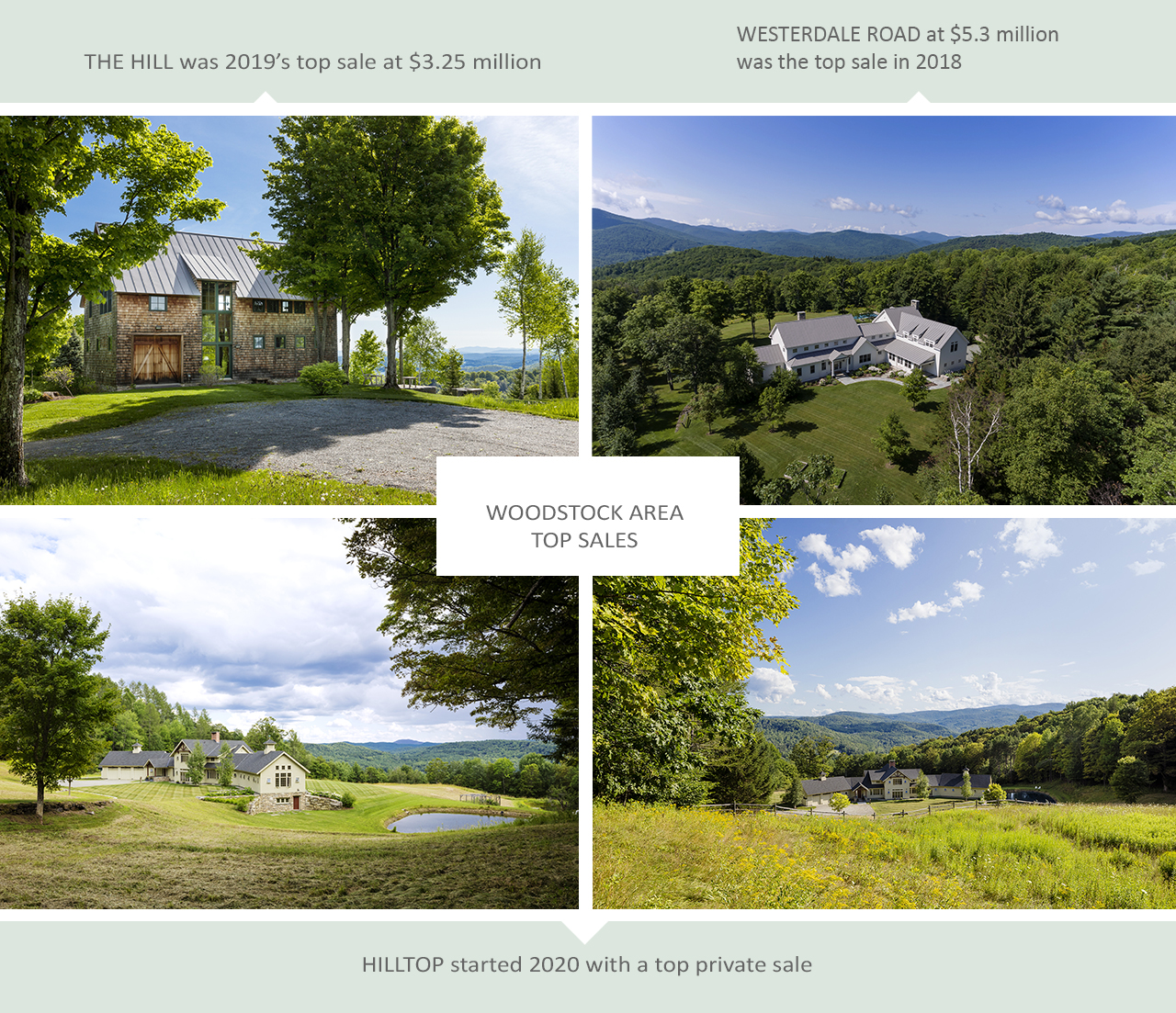

The top 2019 Woodstock sale of $3.25 million did not match 2018’s top sale at $5.3 million, but a major private sale in early 2020 reaffirms that realm of sales price for truly exceptional properties. All of these sales were led by LandVest.

Days on market shortened by 9 days to 169 days in 2019. It’s important to note that the top sales had much shorter days on market due to accurate pricing. There is a huge disparity between the years on market of overpriced properties versus days (or hours) for those that come on with realistic pricing.

Sales by tier dropped slightly in 2019, with 12 sales over $1 million, 2 sales over $2 million and 1 sale north of $3 million (13/3/1 in 2018). The private transaction mentioned above was contracted in the late summer of 2019 with a delayed closing, so it will show up in the 2020 numbers.

Vermont Market Trends

Statewide, 2019 represented another strong or solid year for Vermont’s high-end real estate market ($1m+):

- As in Woodstock, gross sales fell slightly statewide, by about 2%, reflecting fewer great homes available for sale despite strong demand;

- Median sale prices statewide fell slightly, with the top sale at $3.71 million below 2018’s top sale of $10.5 million;

- Days on market for properties over $1 million throughout Vermont fell by a notable 15 days to 182 days, again reflecting tighter inventory conditions;.and

- The number of sales rose slightly to 105 sales over $1 million, 19 over $2 million and 4 over $3 million (102/14/2 in 2018). Chittenden County in Burlington and along Lake Champlain showed the strongest increases – see our update on that market here.

2020 Outlook

The early months of 2020 have been very active, though a shortage of great properties on the market has resulted in a slower pace of sales than buyers would like.

Despite a tighter supply/demand situation than there has been for years, that hasn’t translated into better pricing for marginal properties. In a market which is largely discretionary, buyers simply won’t step up for properties they don’t like or don’t represent compelling value.

We are seeing a much greater appetite for land, despite very high prices for new construction, often three to four times the cost of purchasing existing properties. The driving factors are privacy and buyer preference for greener, more modern construction.

Looking forward, the major unknown is the impact of uncertainty around pandemics, the election and the equity markets. It is encouraging that coming into these potential headwinds, the market is structurally in the best shape that it has been for over a decade.

Got questions? Want to know more? We’d love to help! Contact any member of our Woodstock team:

Dia Jenks, Story Jenks, Chris Lang or Ruth Kennedy Sudduth.