Terry Sortwell in our Camden, Maine real estate office offers his perspective on a recent Economist piece.

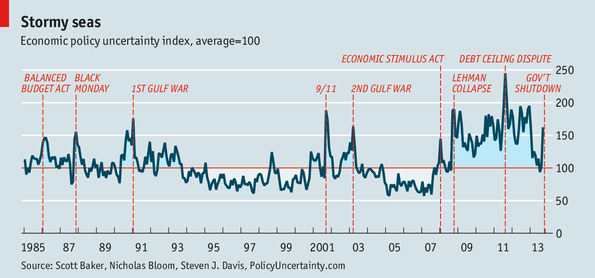

This graph representing the economic policy uncertainty index appears in an article in the latest Economist magazine. Historically, when the uncertainty index has been below the average of 100, we have had a strong real estate market at the upper end–i.e., 1992 to 2000; 2002; and 2003 to 2007.

It looks like the index had just dropped below 100 for the first time since the Lehman collapse of 2008 when the current crisis in Washington drove it back up to over 150. From our very local perspective, the second home market has again slowed down after a bit more renewed optimism and activity over the summer. However, we are encouraged that the uncertainty index reached such a low level during 2013, and hopeful that now that the current crisis has been resolved we’ll see it fall again. The question seems to be whether the branches of government can work together to provide a stable economic environment that will provide some level of certainty moving forward. If so, and if recent history is any guide, then we should see the market again beginning to move.