The economy feels unsettled. Unemployment is negatively impacting white collar jobs. Consumer sentiment is down. The Federal Reserve is holding rates flat, with no clear timeline for cuts. Costs remain high, and uncertainty is a constant in conversation.

Gold reflects that unease, moving from $4,000 to over $5,000 per ounce in a matter of months — a signal of caution, not confidence. Add early cracks in the AI race, infrastructure constraints, and questions around Fed independence, and there’s plenty to watch.

Why I’m not bearish

Despite the noise, I’m optimistic. There’s 7.6 trillion dollars sitting in money market funds — the most sidelined liquidity we’ve ever seen. Inflation is easing, particularly in energy. Gross domestic product continues to grow. Capital hasn’t left the system. It’s waiting.

More importantly, money is beginning to rotate back toward parts of the economy that produce durable value and drive employment.

We still make things in America

When I say we still make things in America, I’m not strictly referring to manufacturing. I’m talking about financials, materials, industrials and pharmaceuticals — sectors tied to earnings, demand, employment and long-term growth.

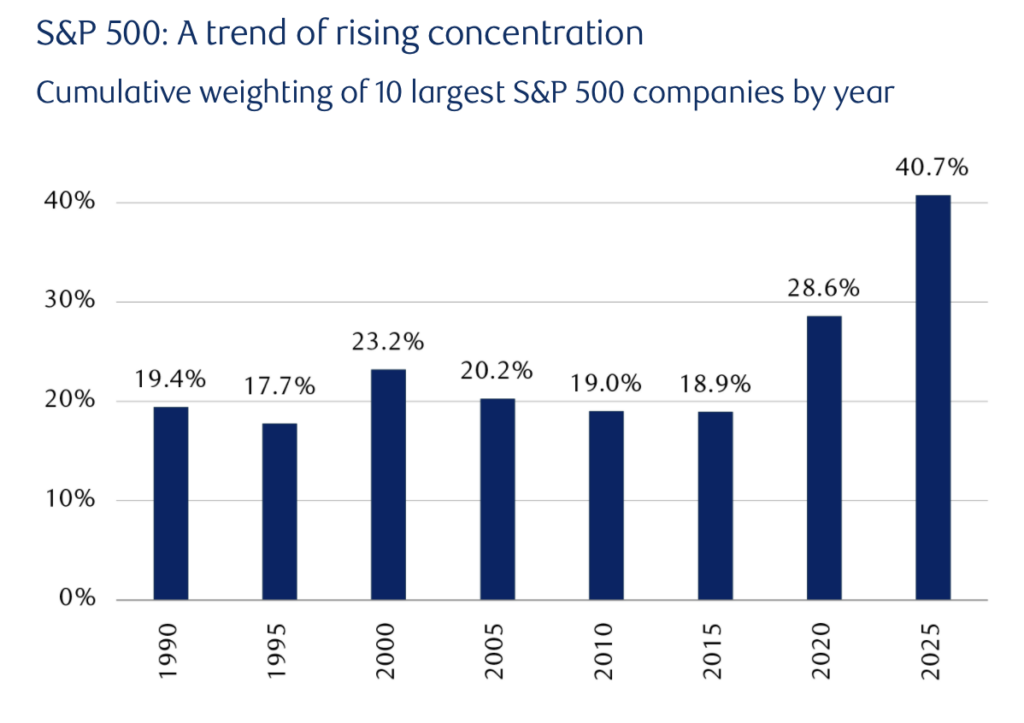

Today’s stock market is unusually concentrated. A handful of technology-driven names dominate the indexes, while hundreds of companies remain fairly valued or undervalued. As rates ease, money moves, and it tends to move toward value.

Why this matters for real estate

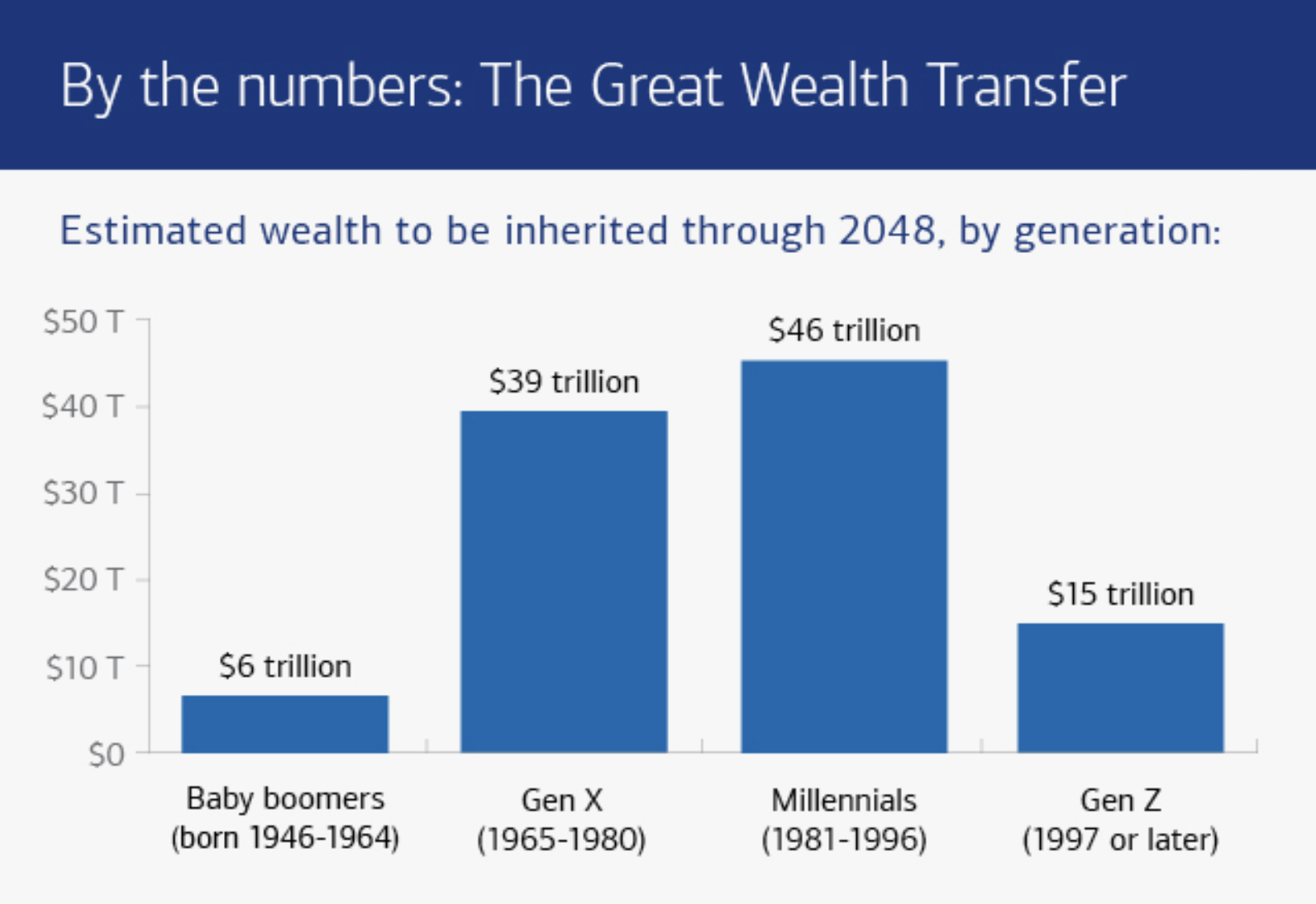

That pivot matters for housing, particularly at the luxury level. We’re in the early stages of one of the largest wealth transfers in history. Approximately 3 trillion dollars in real estate will pass to younger generations in the next decade. Even greater is the over 20 trillion in financial assets held by its owners. These households approaching or in retirement now have significantly more capital than expected. That liquidity continues to drive demand.

At the same time, the U.S. housing stock remains severely underbuilt. For more than a decade, new construction has failed to keep pace with population growth. Luxury housing, in particular, is rarely replaced at scale.

The window sellers should understand

This is still a constructive market, particularly at the upper end, and it may remain so in the near term. But today’s shortage is a function of timing, not permanence. As “America’s Largest Generation“ moves through the system and demographic demand softens, inventory will rise and pricing power will shift. For sellers considering a move within the next 5 years, the window is likely front-loaded. The advantage exists now — not because the market is overheated, but because supply remains constrained.

Real estate is a game of musical chairs. The risk isn’t moving too early. It’s waiting until the music stops.