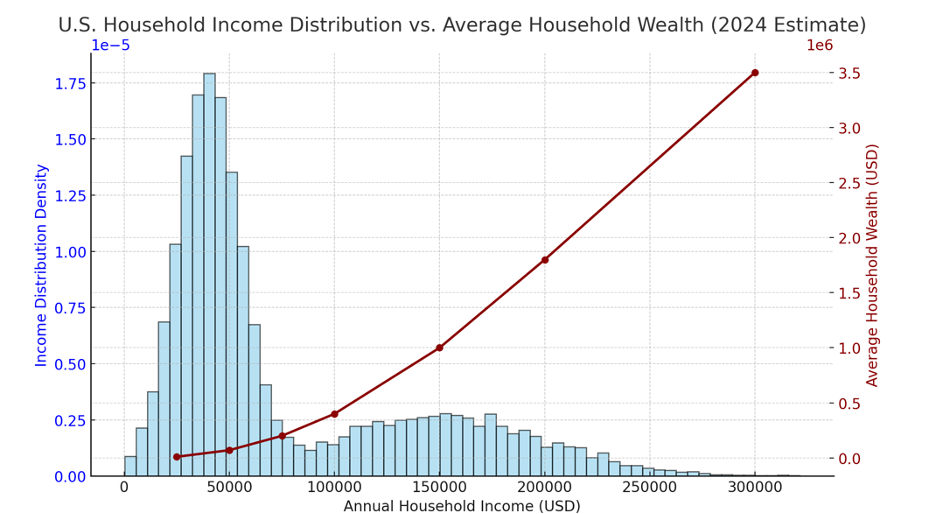

We’ve long talked about a bimodal economy, the haves and the have-nots. Presently that wealth and income gap is widening faster than ever, and it is unsustainable. When I look at statistical correlations among key performance indicators like interest rates, inflation, unemployment, and GDP, it just doesn’t make sense. Data trends used to be straightforward with trailing KPI’s accurately predicting future behaviors. Lately, however, they’re conflicting in ways that feel almost nonsensical. Some of it, I think, is masking where the real performance lies in the economy.

The LandVest Economic Index

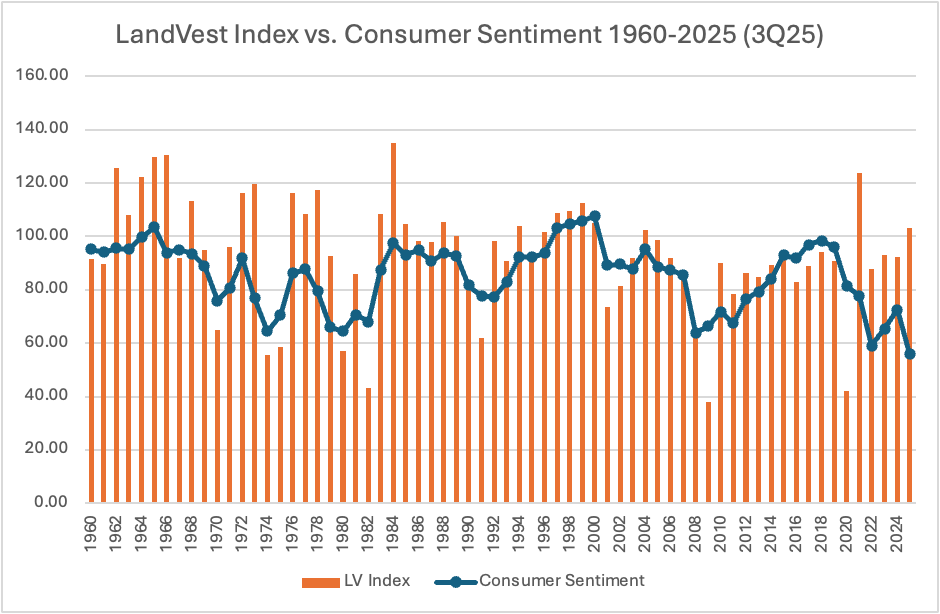

First, let’s check in on the LandVest Economic Index, which tracks the gap between how the economy is performing and how consumers feel about it. In the second quarter of 2025, the index was relatively balanced at +6.5. This meant that the economy was 6.5 points better than consumers felt about it. By the end of the third quarter, however, the delta was +47.0, meaning that the economy was 47 points better than the consumer’s perception of it. That is the second largest gap observed in the last 65 years. The only higher reading came in 2021 when the economy was beginning to exit the COVID pandemic. In other words, Americans once again feel bad about a great economy.

Two Economies, One Country

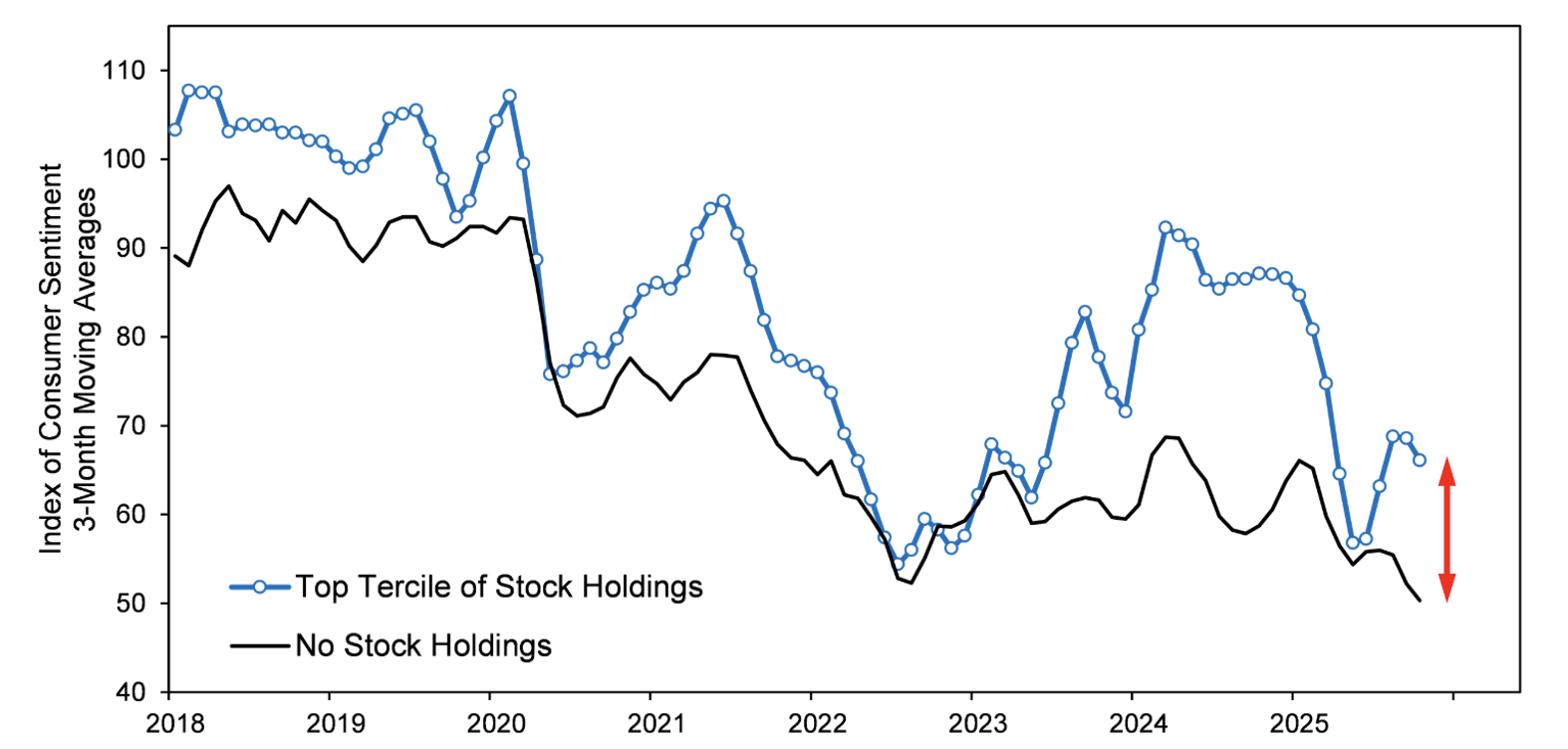

Upon closer review, it is clear to see the bimodal humps in our camel economy. Look at this graph of meta-data from the University of Michigan’s consumer sentiment survey. The figure compares the sentiment of the top 33% stock-owning families vs. those who own no stock. Based on the graph, when the LandVest Economic Index was somewhat balanced in May, stockowners and non-stockowners were in relative agreement on the state of the economy. Since May, however, the wealthy have improved their view on the economy, where the middle to lower class view has declined.

Meanwhile, in Housing

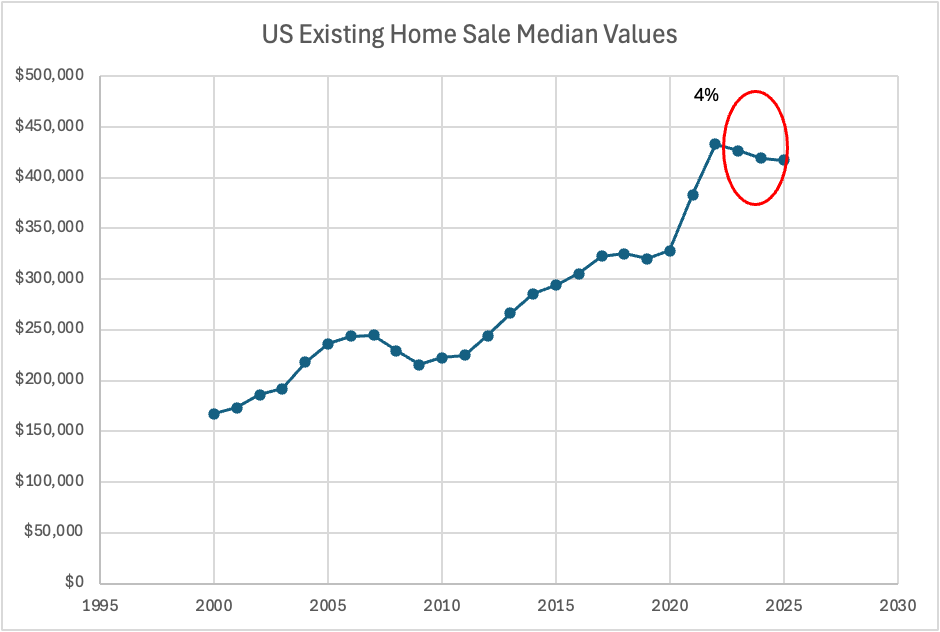

The housing market has been in correction since 2022; we just don’t want to admit it. Median home values are off 4% since the peak, yet the correction appears to be focused in the retail market, versus the luxury segment which continues to set new records.

Why does the upper end of the market continue to climb? I think this is another result of our bimodal market economy, where investors are enjoying the meteoric rise of the Magnificent 7 stocks, which collectively make up over 1/3 of the S&P 500’s market cap.

The Takeaway

I think that inflation is occurring in luxury goods at a faster rate than retail. I believe that the lack of increase in CPI is masked by unusually low energy costs. I remain convinced that $4,000 gold and DOW 46,000 are incongruous. I think that asset values will correct, but the correction will be smaller at the higher end of the market. Fundamentally, I believe that the wealthy will continue to feel good about their economy, while the middle class will continue to be anxious about theirs, which is unsustainable.