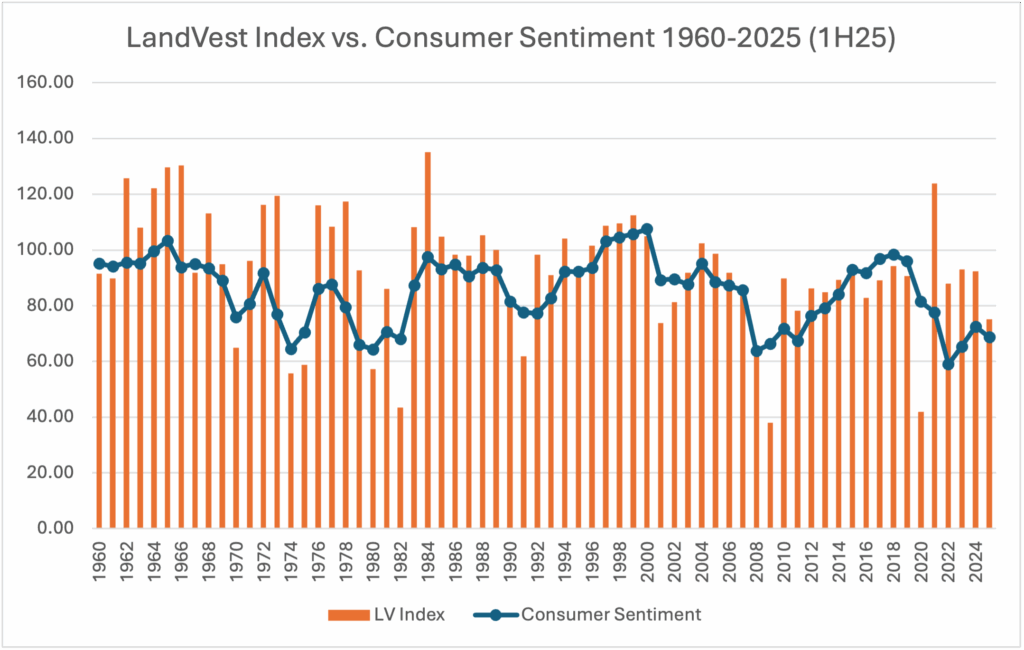

Last quarter, I introduced the LandVest Economic Index, as a measure of how well our economy was performing. The index is a scaled measure of unemployment, GDP growth, and inflation. I plotted the index against the University of Michigan’s survey on consumer sentiment and found that at the end of this year’s first quarter, Americans felt really bad about a really great economy.

In fact, the Q1 gap between how bad we felt about the economy versus how good it really was, logged the lowest observed since 1984, at a rating of +36, meaning the economy was 36 points better than the view of the consumer.

What a difference three months makes! I updated the data through the first half of 2025, and the consumer sentiment has course-corrected to a more traditional view. We went from feeling bad about a great economy, to feeling great about a good economy. The gap has closed to a +6.5, which is in line with the 65-year average of +8.0. In other words, the consumer view of the economy is consistent with economic KPI’s.

Despite a decline in new employment and negative revisions to the June and May jobs reports, the outlook of consumers has brightened. In the face of increasing inflation from tariffs between the first and second quarters, consumer spending has accelerated. In response to elevated imports in the first half of 2025, as manufacturers and consumers built inventories in advance of tariffs, consumers have doubled-down on their spending and confidence.

We are, in the end, uniquely American, and statistics typically revert to the mean. The balance of consumer sentiment versus the economic outlook is a good sign. The uptick in consumer spending is an even better indicator, because as much as I like the LandVest Economic Index, it is a trailing indicator, while consumer spending is a leading indicator.

Despite the recent corrections, employment remains historically robust. Inflation will moderate as the background noise surrounding tariffs quiets. Consumer spending is increasing, which is the primary driver of GDP. I am cautiously optimistic for a strong second half of 2025.