More Homes For Sale, But Location Matters

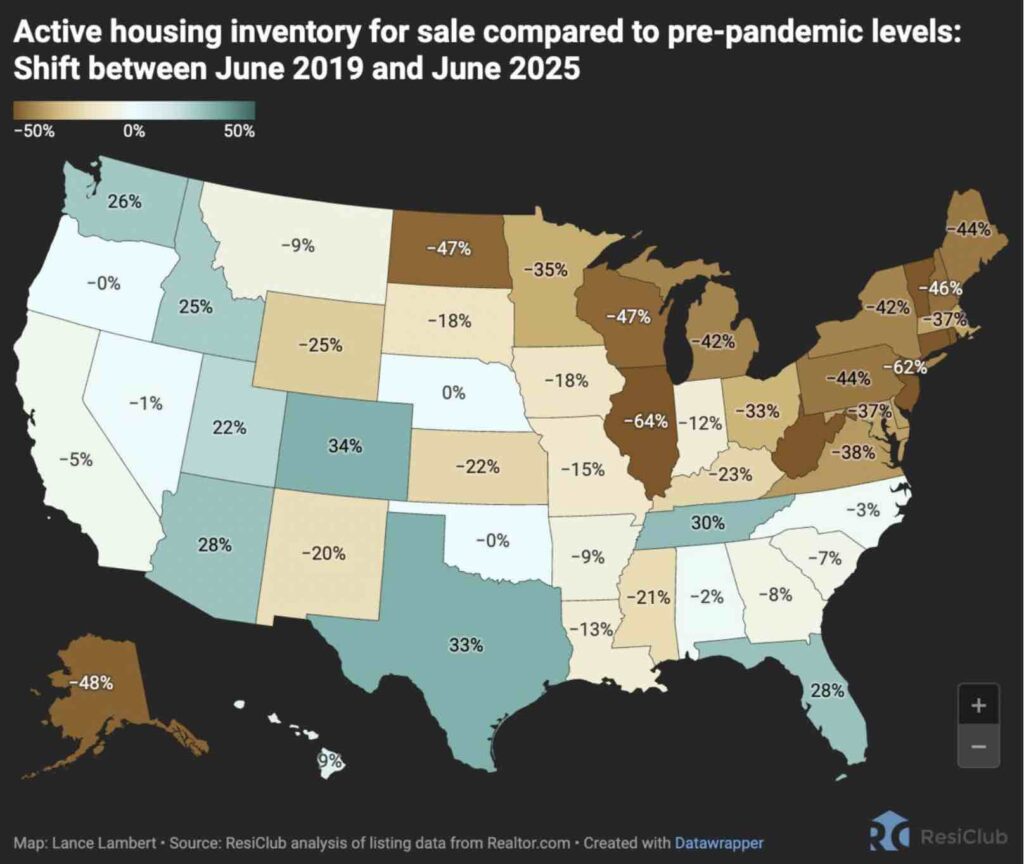

An eventful first half of 2025 is in the books, and we’ve seen U.S. housing inventory continue to climb towards pre-pandemic levels. The current number of houses for sale trails 2017-19 levels by about 11% but it’s grown, year over year, for 20 consecutive months.

While national numbers are informative, they shouldn’t be misinterpreted. They represent a mix of vastly different local and regional dynamics—at any given time conditions vary dramatically across the U.S.

From a 10,000-foot view, the South and West have far more homes on the market, which dampens pricing in those areas and encourages buyers. The Northeast and Midwest, where many states still have 40-60% fewer homes available than before the pandemic, are more favorable to sellers.

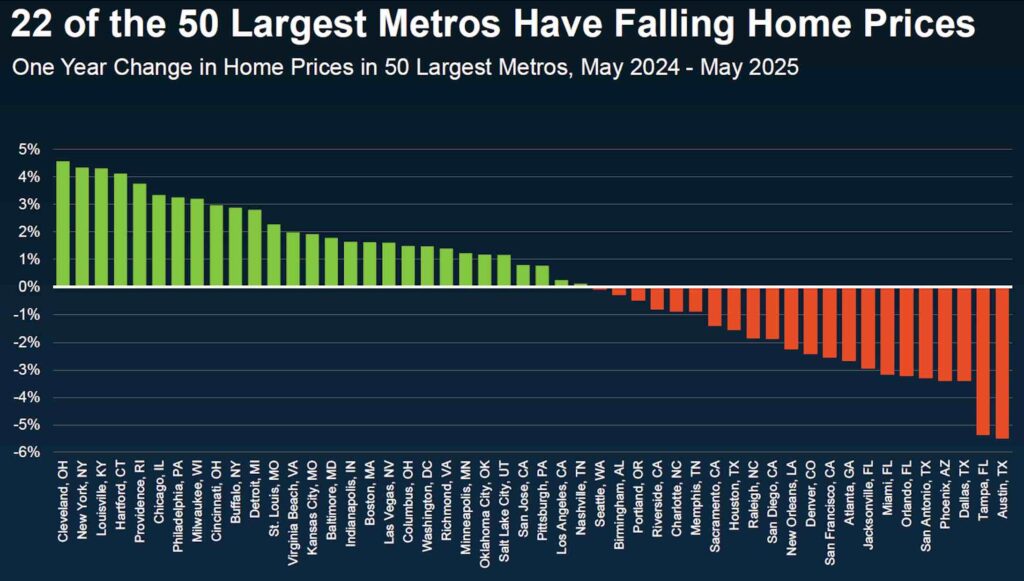

Where Are Prices Rising—And Falling?

Home prices in the 50 largest U.S. metro areas are headed in opposite directions, with 28 rising and 22 falling during the 12 months ending in May, according to ResiClub data. Prices have plunged in markets that had been among the nation’s hottest, evidencing a boom-and-bust pricing cycle in much of Florida, California, and Texas.

On the other hand, New England and broader Northeast markets continue to see prices rise with persistent demand, limited inventory, and no obvious relief in sight. Median list prices, and list prices per square foot, climbed more in the Northeast than any other region. With building costs persistently high, it’s clear that people are paying a premium for finished homes while avoiding the cost and timing uncertainties of new construction and renovations.

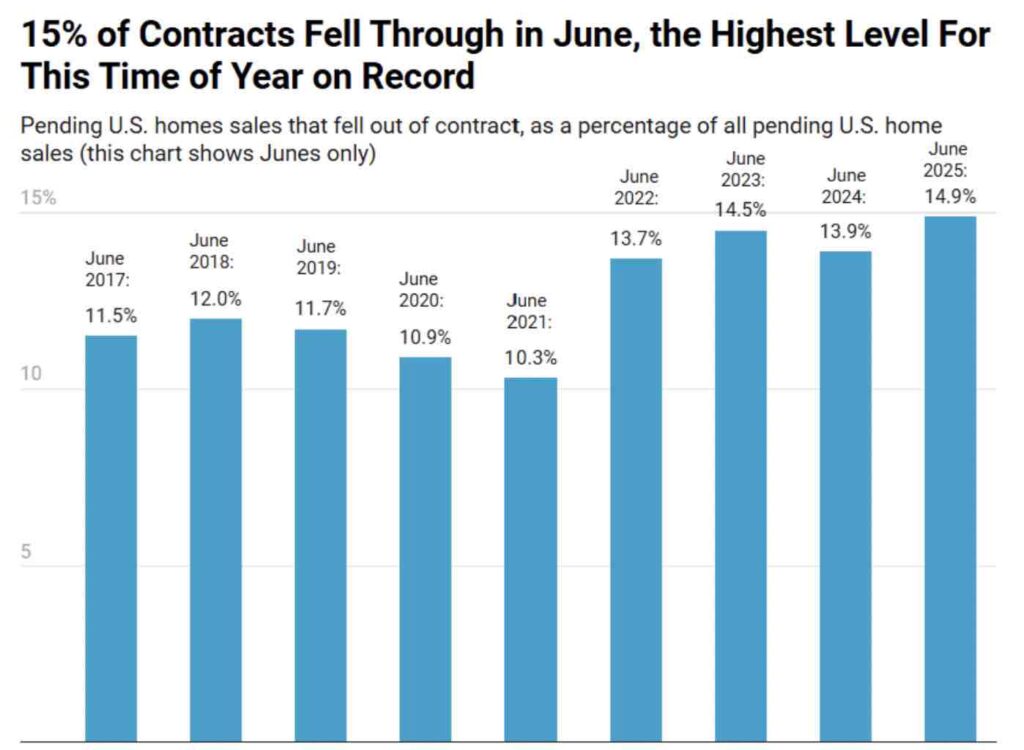

Fewer Buyers, Many Frustrated

High prices, economic uncertainty, and limited inventory are pushing some potential buyers out of the market.

Just 18 months ago the numbers of active buyers and sellers were in balance, according to Redfin. Since that time far more sellers have entered the market, while the pool of buyers has dwindled, creating an imbalance and leaving the remaining buyers far more uneasy about market conditions.

That uncertainty is causing contracts to fall through at a record rate. Nationally, 15% of all June contracts failed to close. In some markets the number topped 20%, though in the Boston metro area only 10% did not reach the finish line. Buyer frustration is boosting relocation thoughts in some markets. Redfin data shows Boston metro residents conducted 72% of their searches for homes outside the area. That’s the 9th highest rate among U.S. metro areas and a huge jump from 2024, when Boston metro ranked 26th. The data suggests that Boston metro buyers, facing high prices and fewer options, are beginning to look elsewhere. Secondary cities outside major markets, like Springfield, MA, are showing some of the nation’s highest levels of demand thanks to this trend.

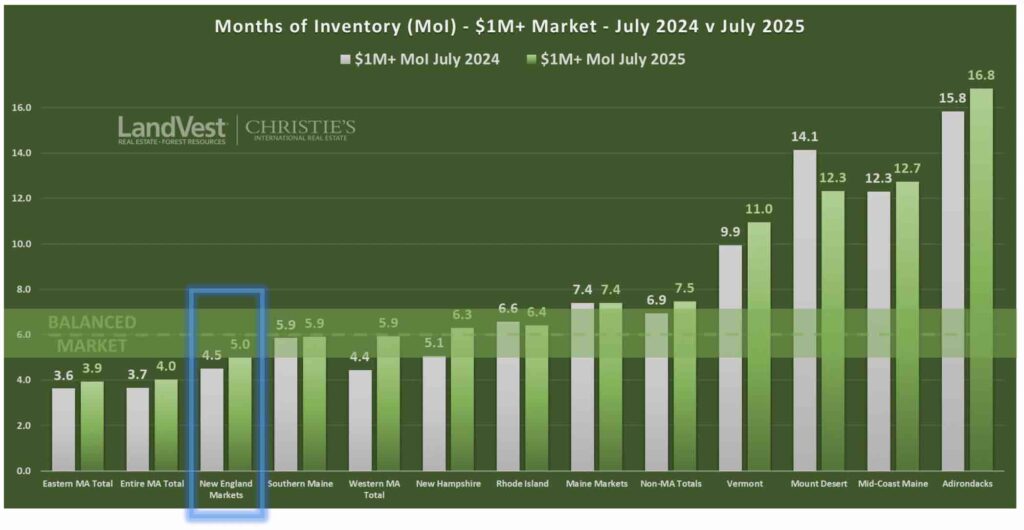

New England Inventories Tight, But $1M+ Buyers Have More Options

New England is home to many distinct markets, which vary widely and change independently. That’s a major reason why LandVest’s regional experts, with their local knowledge and experience, offer key insights for buyers and sellers navigating the landscape of luxury real estate.

It’s important to remember that location isn’t the only factor differentiating real estate markets or listings within a market. Property values often create different market conditions within the same town. That’s encouraging news for buyers of luxury properties in the $1M+ valuation, who currently have more options, and a bit more leverage, than buyers at lower price points.

Vermont is a prime example. The state’s total inventory is tight, but the high number of $1M+ listings puts it squarely in buyers’ market territory, joining the Adirondacks, Mount Desert Island, and Mid-Coast Maine. Nearly all other New England markets are more balanced at the luxury level than they are overall. High-end buyers in LandVest’s core markets can expect to see more opportunities through the summer months and into October when New England home inventories typically peak with the foliage.