We measure our economy in many ways, such as employment, inflation and GDP. We also measure consumer sentiment. In theory, there should be some correlation between the two, and there is. However, the relationship is surprisingly low when it comes to periods of inflection. Recently I’ve become curious about how we feel, as consumers in the US economy vs. what the economic data actually tells us. The results are surprising.

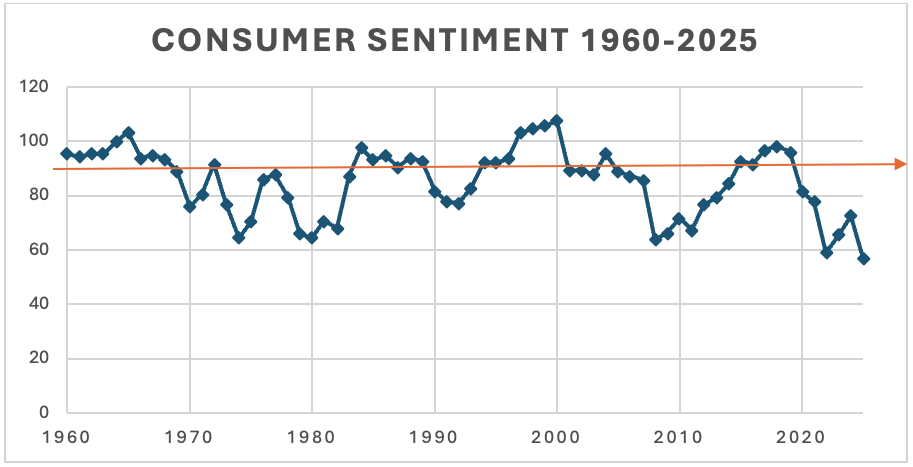

Presently, our economy has a self-esteem problem. According to the University of Michigan survey, consumer sentiment is the lowest we have seen in the past 65 years. We actually felt better about the economy in 1974 during the Arab Oil Embargo; 1980-1982 during the “double-dip” recession; and even in the darkest hours of the Great Recession. In fact, the 2008 index of 66 (second lowest since 1960) is a full 16% higher than the 1Q25 reading of 57. We really don’t feel good about ourselves, especially considering the average rate is 85.

Why such low sentiment?

There are few, if any fundamental measures of the economy which support our own dire forecasts. According to the Bureau of Labor & Statistics, unemployment is still hovering at a decades-low rate, 30% below the long-term average. First quarter inflation, as measured by the Federal Reserve Bank’s index for all consumer pricing, came in at less than half of the 65-year annualized rate of 3.73%. Up until March (when panic import buying skewed the GDP calculation), the measure of Gross Domestic Product was humming along near the 2.97% long-term rate. We are doing really well.

Introducing the LandVest Economic Index

In an effort to gauge how extreme our perception of economic imbalance has become, I created a scaled index which incorporated the employment rate, GDP and Inflation (I call it the LandVest Economic Index). I then plotted the index against the survey of consumer sentiment. I was genuinely shocked by the results.

The current delta between how good the economy actually is vs. how bad we think it is, comes in at 36. It is the third largest gap observed in the last 65 years, sharing top ranking with 1984 (at 37) and 1978 (at 38). The puzzling thing is, however, that 1984 and 1978 both reflected post-recessionary environments, where consumers still lacked trust in economic resilience. To the contrary, we are in the midst of a five-year economic boom in the post-covid recession recovery. It just doesn’t make sense.

So yes, you can feel better about it.

The fundamentals of the economy are sound. The stock market is not the sole measure of the economy. The April slide in GDP was a self-inflicted “technical” decline. Unemployment and inflation remain at cyclical lows. Although the economy appears to be on pause, there are no fundamental KPIs that suggest we should be going into recession, apart from our own anxieties. This temporary lapse in market confidence should create buying opportunities, similar to those which existed in April of 2020. We just need to feel better about ourselves first.