MARKET UPDATE

A year ago at this time, we were optimistic about the direction of the land markets. We predicted the continuance of a strong but slightly softening market for retail tracts and an increase in demand for institutional-grade forestland. 2021 did not disappoint.

Throughout the year, we observed a shift in market dynamics resulting in an ascending market for forestland assets. At least three factors are driving this shift: (i) growing interest in ESG investing and climate solutions, (ii) changes due to the Coronavirus pandemic, and (iii) the emergence of inflationary pressures. These trends have led to a significant increase in liquidity and investor desire to place capital in forestland assets.

The ESG and climate solutions focus is the most prominent driver of improved interest in land assets. Evidenced by substantial net-zero carbon commitments from many corporate interests, there is significant capital availability seeking forestland assets. This subset of investors/developers are bullish on carbon and recognize that direct forest ownership provides a superior means of capturing high-quality, natural-solution carbon offsets, alongside traditional benefits of direct land ownership.

Lumber prices experienced an incredible run during the pandemic, fueled by a change in demand from service to commodity-oriented products, coupled with manufacturing disruptions and worker shortages. Housing starts remain strong, and prices for solid-wood products are expected to appreciate or remain steady, both short and long term. Pulp markets are mixed but generally positive with pulp and paper producers growing concerned by the developing market for carbon which could reduce feedstock availability, further improving demand for low-grade fiber. The retail land markets have also seen a strong run—continuing in many areas—as a result of the pandemic’s “flight to safety” reaction and new corporate work-from-home policies.

The third market influencer is inflation. Investments in forestland have long proven to be a good hedge against inflation since timberland values are derived from a broad array of end products across many segments of the economy. With a growing realization that current inflation is not transitory and may be with us through 2022, forestland presents an attractive hedge for investors.

WHAT LIES AHEAD

As we look towards the continued building interest in forestland and its associated attributes, we expect the market for institutional lands to be extraordinarily strong and retail land markets to continue on a similar trajectory well into 2022. Demand for land is generally outpacing supply across a broad range of shelf space and geographies—a trend that will encourage sellers to take action in 2022. Those groups, assisted by professional, transparent, thoughtful, well-executed marketing, with a strong domestic and international reach, are best positioned to achieve superior results. Call LandVest for a free consultation.

About LandVest

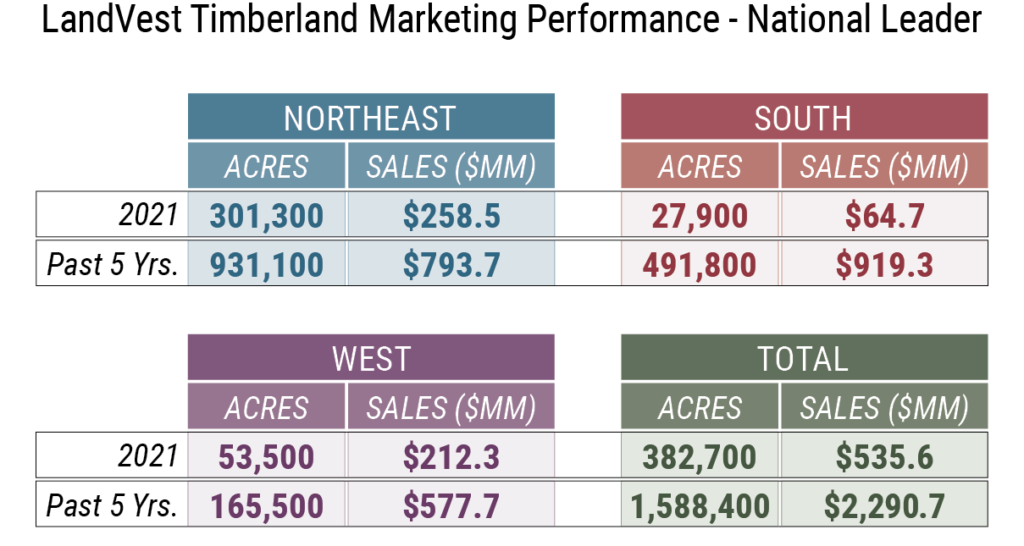

LandVest is the national leader in timberland transactions and manages more than 2.2 million acres of private forestland across the country. We employ nearly 60 full-time foresters, GIS technicians, biometricians, surveyors, and other natural resource professionals. LandVest provides comprehensive land services including acquisition due diligence, operational logistics, forest management planning, timber sale administration, growth modeling, non-timber asset evaluation, and financial analysis to assist our clients in reaching their management and transaction goals.

For more information, please contact:

Jonathan Burt

Director, Southern Region

(404) 545-6300

jburt@landvest.com

David Speirs

Director, Northeast and Lake States Regions

(207) 874-4982

dspeirs@landvest.com

Sam Porter

Director, Western Region

(541) 810-3882

sporter@landvest.com