A few weeks ago, we looked at the Vermont market as a case study, where COVID-fueled interest in rural properties drove a near tripling in sales of luxury properties. Today we look at the COVID land rush across New England and nationally.

Six Takeaways:

- It is all about the K-shaped COVID impact and recovery: wealthy and young mobile tech/knowledge workers are driving demand for real estate.

- WFH and “co-primary” living will be persistent trends.

- Millennials aren’t so different, after all. Turns out when they make their money and get older, and especially when spurred by a pandemic, they want somewhere leafy, salty, mountainous, or by the lake and somewhere urban for post-pandemic world, just like their boomer parents, the English landed gentry, and the Medici before them.

- A changing climate may also play a role – more on this in a future blog.

- Lack of rural and suburban inventory is a huge constraint on the real estate market currently, exacerbated by demographics where a huge, wealthy group of Millennials want to purchase country and coastal estates. (Stay tuned for more on this.)

- This extreme pandemic swing to rural and suburban markets will lead, in time, to an equally dramatic swing back to the cities as they emerge from the pandemic offering the joys of urban life we’ve been missing for the last year. (It’s already starting to happen, see below.)

Let’s expand on four of these in the following charts and commentary.

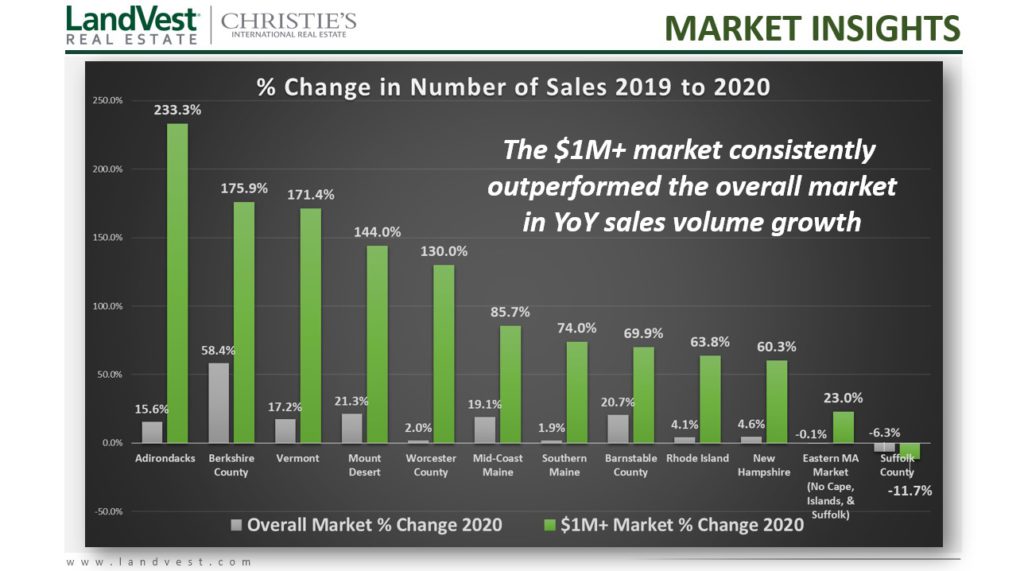

1. The K-shaped recovery

The same K-shaped recovery we are seeing in employment is also driving real estate markets: The million-dollar plus markets, and the country retreat markets in particular, are very strong, while the urban markets have been weakest. (This is starting to turn, with recent recovery in demand in NYC, with contracts for sale hitting 13-year highs in January, though at lower prices than pre-COVID.)

2. WFH and Co-Primary, get used to it:

Folks who can work from home, want to work from home.

Home is often somewhere new. And for those that can afford it, there may be more than one or two homes.

“Co-primary” homes are the new second homes…

…and they have to have high-speed internet.

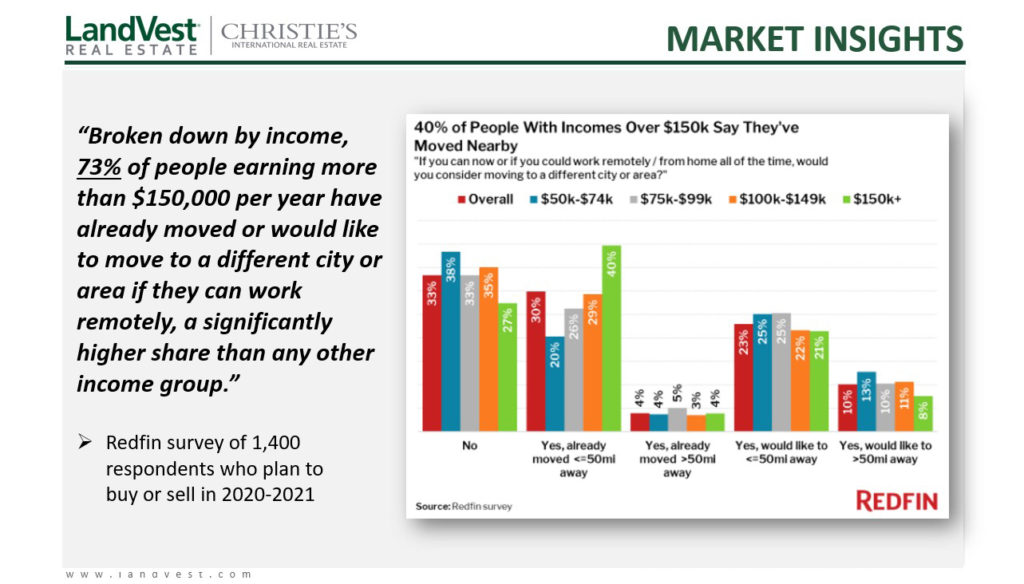

Survey data indicate that many wealthier folks are planning to move or have moved because they can now work remotely and expect to continue to do so.

One of the keys to the sustainability of this trend is how companies are responding to remote work. How will compensation shift for remote workers – will they be rewarded for helping corporations reduce overhead costs or penalized because the cost of living is lower in Boise, say, than in the Bay Area? Employees say that salary reigns supreme, based on a recent survey of more than 2,000 employees and human resource managers in Q4 2020.

Remote real estate purchases are a reality: 63% of people who bought last year, bought without visiting in person. LandVest and other top luxury brokers in our network report that this is not by choice. Going forward, buyers will expect to be able to shop remotely, but vastly prefer to buy having visited in person.

3. Millennials: they are not so different, and there are a lot of them.

They may have married later, and bought later, but once they get to that stage of life, they want to live somewhere great, and often in more than one great place. Older Millennials and Gen Xers (30-54 years combined) are nearly 50% of the buyer pool. In our shop, we are seeing younger and younger buyers of expensive second homes.

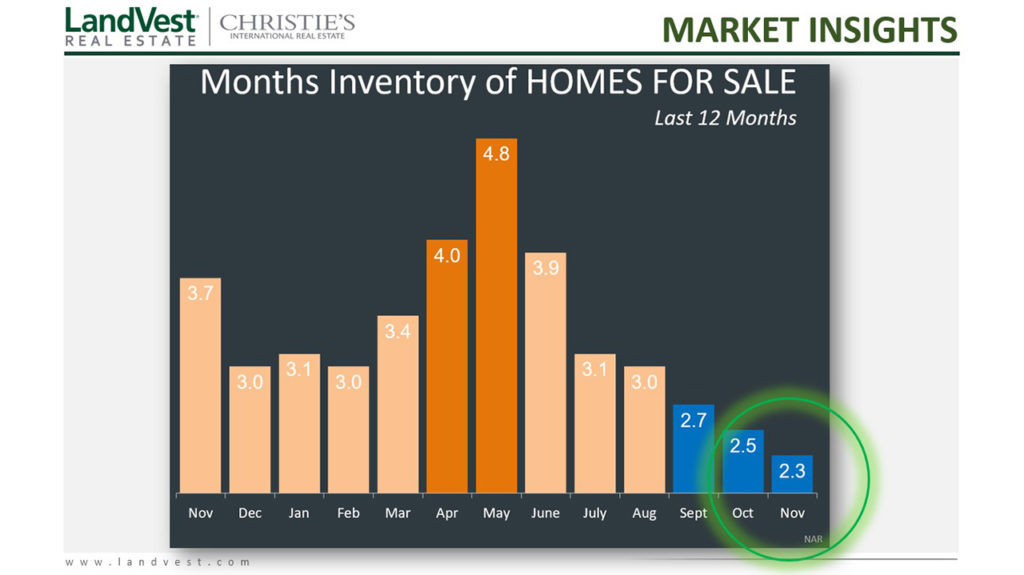

4. Lack of Inventory is a HUGE issue

Brokers nationally are reporting a massive scarcity of houses to sell. It isn’t clear how much of this is being driven by scarcity of sellers because it is hard to move during a pandemic and harder to buy when there is no inventory available. It is certainly due to a lot of folks moving up and out, and not into city condos or rentals. We suspect it is both. More to come on this shortly.

In the LandVest demographic, we see more people buying an additional place (on the water, in the country, out of town) than selling. That constrains supply in these traditional second-home markets.

We’ll keep you posted. If you have questions, or you’d like to see Slater Anderson’s awesome full deck of data from which these were extracted, let us know. We’d be happy to talk and share our thoughts with you. Feel free to reach out anytime:

Ruth Kennedy Sudduth

Vice Chair

617-359-5584

rkennedy@landvest.com

Slater Anderson

Managing Director, Real Estate

978.828.7557

sanderson@landvest.com