Market commentaries usually feature well-worn tropes often describing the same circumstances: “these are unprecedented times,” “we are seeing the continuation of a trend in place,” and “it’s different this time, and will have lasting impacts.”

That’s true this time, too.

These are unprecedented times: at least we think so, since we don’t know much about the real estate market through previous pandemics. The initial forecasted market collapse has been met instead with robust, if not frenzied, buying in second-home and some suburban markets. Even in-town urban markets like Boston and Portland seem largely to be recovering from almost a full stop.

This is a continuation of trends in place: the flight to the cities of the post-2008 era had begun to reverse (see these blogs), but the search for space for everyone to work from home and for adult children to return to has combined with the sheer logistical challenges of selling and moving during a pandemic to make for a major supply/demand imbalance in suburban and second-home markets.

It’s different this time. The pandemic will have lasting effects on how people live and the choices they make around real estate. Houses are likely to be bigger, further from urban centers, and require more wood to construct them. The flight to rural lifestyle will put additional development pressure on land suitable for conversion. These trends are good for LandVest’s core competence in great land, analysis of developable and conservable properties, and timberland.

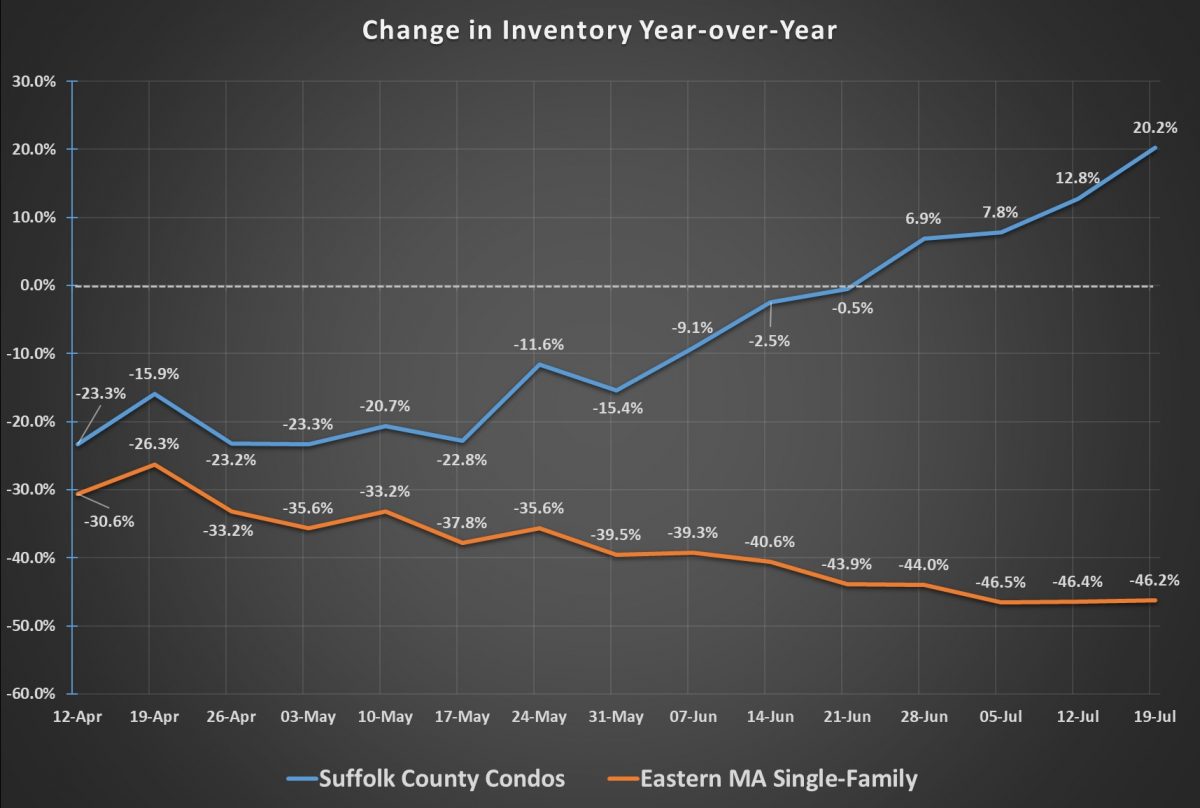

Using just Eastern Mass as an example, here is the change in inventory since last year – showing the supply of single-family houses plummeting, while the supply of condos in Boston (Suffolk County) is rising. “The condo market isn’t necessarily soft, but there is new construction coming on at a time of measurable buyer shift to the suburbs and the countryside. We saw the Boston luxury condo market hit a supply/demand inflection point in November 2019 with prices leveling and even declining in some cases. This was before the pandemic was making news. It’s not surprising that now, with the pandemic, that high-touch elevator buildings with small units are not in high demand,” says Slater Anderson, LandVest Managing Director of Real Estate, whose analytics underly this piece.

Outside of Mass, the COVID diaspora we’ve been talking about has accelerated the rebound in the second-home markets, particularly on the water and in Vermont. Keep in mind that many parts of second-home New England had barely recovered in terms of price from the Great Recession until maybe 18 months ago. The news was full of demographic doom – too many baby boomers selling, Millennials only want to rent, etc. Then Millennials started getting wealthy and having multiple children, the inventory overhang abated, and the market for cool places outside of urban centers strengthened.

Outside of Mass, the COVID diaspora we’ve been talking about has accelerated the rebound in the second-home markets, particularly on the water and in Vermont. Keep in mind that many parts of second-home New England had barely recovered in terms of price from the Great Recession until maybe 18 months ago. The news was full of demographic doom – too many baby boomers selling, Millennials only want to rent, etc. Then Millennials started getting wealthy and having multiple children, the inventory overhang abated, and the market for cool places outside of urban centers strengthened.

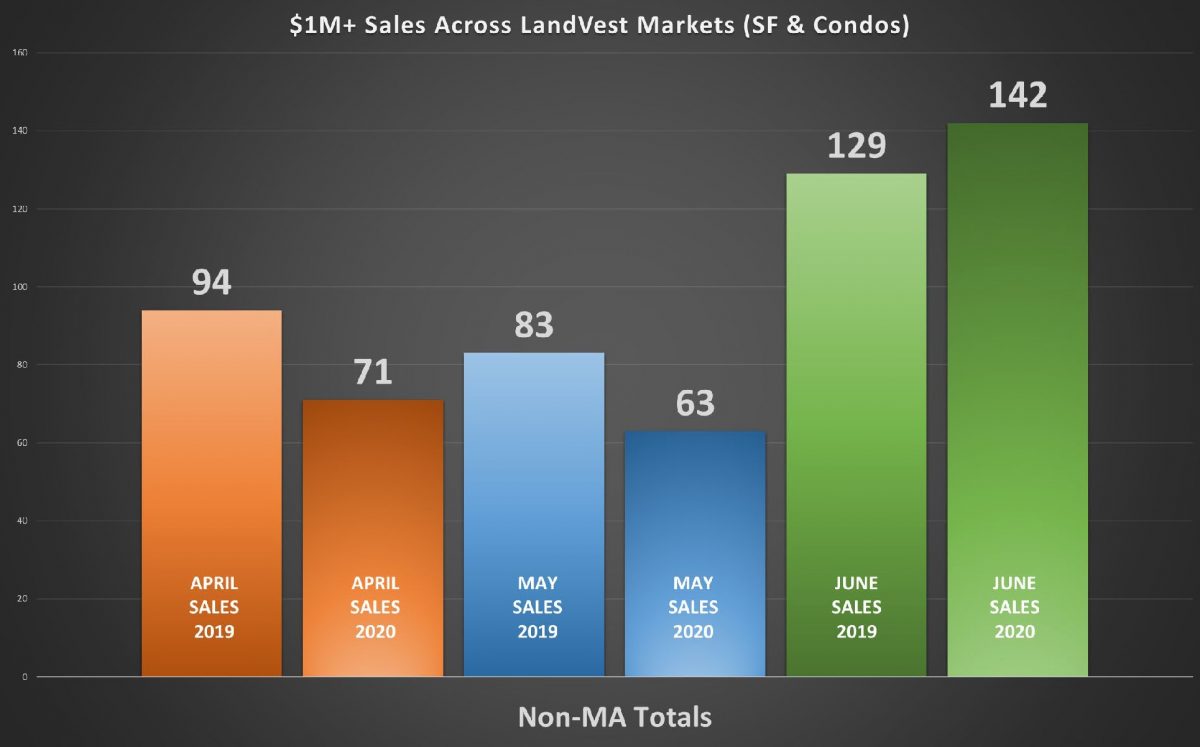

During the spring shut down, second-home market sales dropped, but interest strengthened, and we are starting to see those sales come through, exceeding even the very strong levels of 2019.

Some properties that had been on the market for some time sold quickly during COVID. Peace Mountain, in Woodstock, Vermont, has an accepted offer after only a weekend on the market once LandVest took over the listing. It had previously been on the market for an extended period with other firms.

Birch Tree Farm, a landscape-scale property also in Woodstock, sold for over $5 million, the fourth recent sale over that important threshold. LandVest Woodstock has done three of the four sales, two of them with buyers we have found directly.

What does this mean looking forward?

“COVID will change how people live, just as happened post 9/11 and the Great Recession.“

– Joe Taggart, LandVest President

Everything that no one wanted in 2012 is now what buyers are targeting: lots of bedrooms, an in-law suite, a pool, a home office, lawns, and gardens to play on and grow things.

Generations ‘X’ and ‘Y’ tended to value experiences more than things. Their parents’ sprawling summer homes looked dated, a maintenance burden, and felt like an obligation when compared to limitless possibilities in travel, leisure, and lifestyle. With many of that generation now sheltering in their parents’ summer homes, the Boomer life is back in style.

Generations ‘X’ and ‘Y’ tended to value experiences more than things. Their parents’ sprawling summer homes looked dated, a maintenance burden, and felt like an obligation when compared to limitless possibilities in travel, leisure, and lifestyle. With many of that generation now sheltering in their parents’ summer homes, the Boomer life is back in style.

- Housing starts will shift from multifamily to single-family.

- Demand for lumber will increase as consumer preference favors more, and larger, single-family dwellings.

- Development will spread out again from the urban cores into the suburbs and exurbs looking for bigger houses and open space.

- That will reduce the supply of forestland at the same time consumers are demanding more lumber.

The imbalance in natural resource supply and consumer demand will provide a meaningful lift for our timberland business and for timberland investors. With concerns about government deficits, fiat currency, and potential inflation, combined with interest rates so low that they dare investors to try new things, real assets, like land and timberland investing by high net worth individuals, are getting increased attention.

The imbalance in natural resource supply and consumer demand will provide a meaningful lift for our timberland business and for timberland investors. With concerns about government deficits, fiat currency, and potential inflation, combined with interest rates so low that they dare investors to try new things, real assets, like land and timberland investing by high net worth individuals, are getting increased attention.

Want to know more? We are here to help.