We have been assessing the strong urban real estate recovery post-2008 at the expense of the suburbs and countryside, followed by a shift toward the suburbs and country retreats as the recovery matured.

What are we seeing in market activity in the COVID-19 context?

A clear preference for rural, exurban, and suburban properties with space and amenities.

There are sound demographic reasons for this besides the pandemic story: The surge of demand for urban properties was driven by a large wave of millennial demand on top of demand from downsizing baby boomers.

As millennials (an enormous cohort) started to have children, the demand for suburban living accelerated in late 2018 and 2019. Demand for suburban and rural properties was exacerbated by the sheer lack of affordable urban living throughout the Northeast, as far north as Portland, ME.

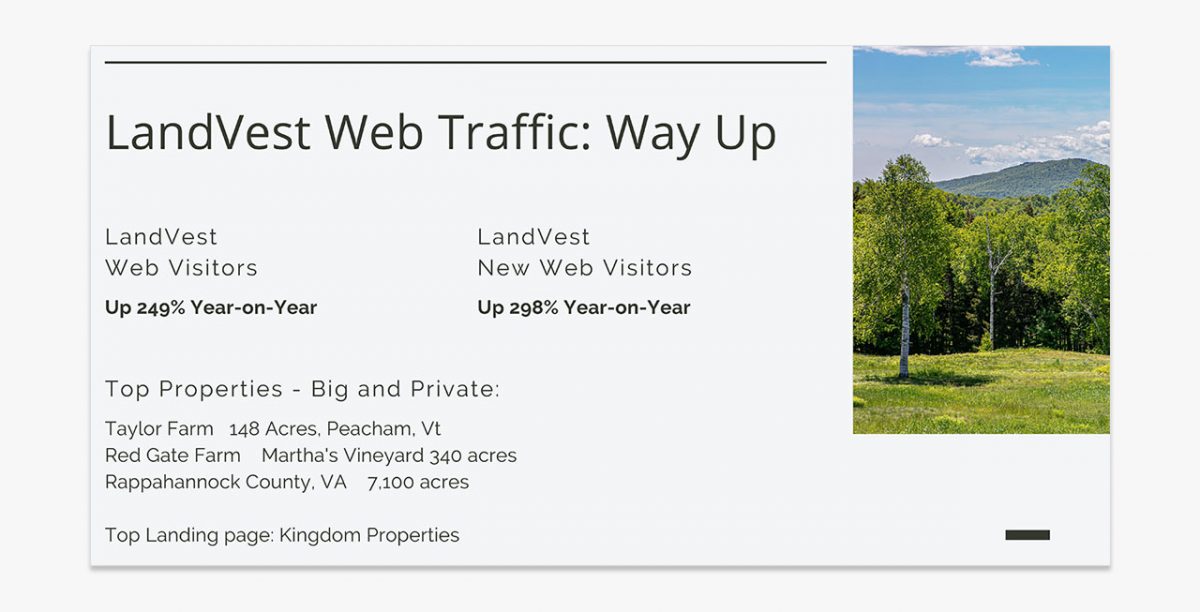

At LandVest, our web activity is clearly showing this theme, with new visitors up nearly 300% year on year. The 5 most-viewed properties on our website are all big, remote, and beautiful, and the top landing page: Kingdom Properties, is all about scale and privacy.

The press is picking up on the story from the Wall Street Journal to the New York Times and for some New Yorkers, it’s time to get out of New York for good.

What are we watching for?

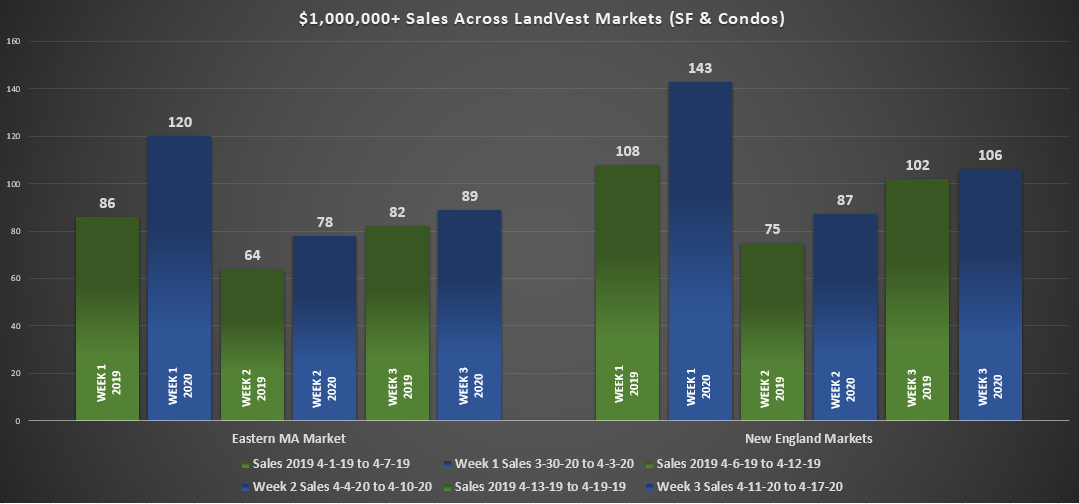

The good news is that so far, the data show a quite decent market for luxury even through the quarantine period.

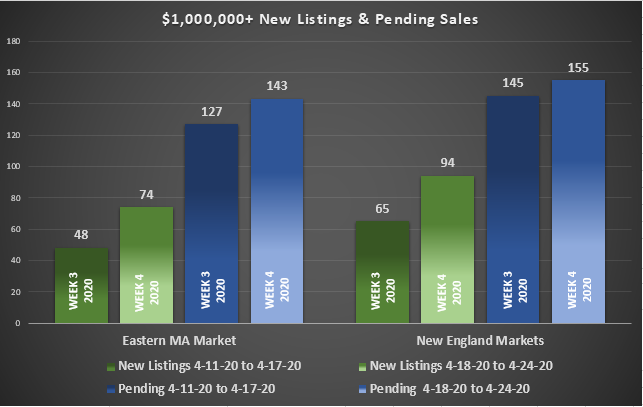

We are watching the number of new listings coming on the market and the implications for supply. Slater Anderson, LandVest’s Managing Director of Real Estate, has been monitoring the data weekly. Here is what we’re seeing:

- Demand, in terms of activity, continues to be decent.

- Pricing has held up. Buyers are expecting lower prices but aren’t seeing them yet.

Will limited supply counteract price drops?

We’ll keep you posted.

The spring market has not delivered the number of homes for sale it has in the past, putting demand pressure on homes that are available even if there are fewer buyers. After a drop in new listings, pending sales, and closed sales in early April, all three of these measures have steadily improved week-over-week.

In the $1M+ market, 2020 has outperformed 2019 each of the past three weeks in our markets.

We will keep you posted on the data as it comes – obviously, these are early days.

Interested in something cool out-of-town? Let me know.

If you have questions, please reach out – we are here to help!