Demographics and the New Realism of Luxury Real Estate

The dominant theme of the post-Great Recession luxury real estate market has been the gap between buyer and seller expectations. This new realism is driven by demographics.

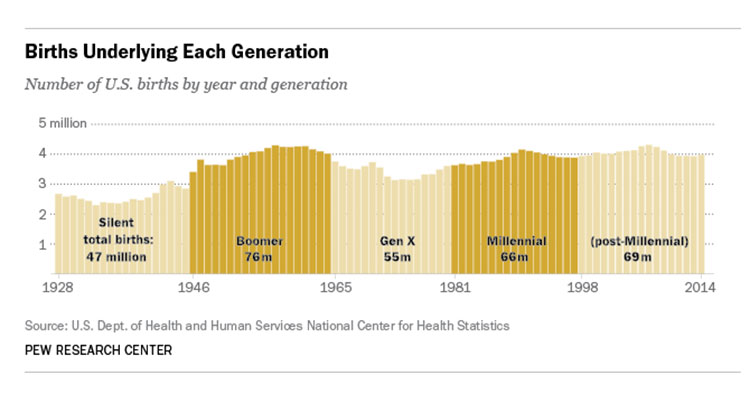

LandVest’s average seller is shifting from the Silent Generation to the Baby Boom generation. For both groups, housing prices have been on an almost continuous rise for most of their adult lives.

Our average buyer is 45. These Gen Xers have been buffeted by the 1989 recession, the 2001 tech bubble and even more so by the Great Recession. Not at all a smooth upward path for real estate or asset prices.

To boot, there are about a third less Gen Xers than there are baby boomers.

Combine a lot of downsizing boomers, fewer Gen Xers, and plenty of millennials moving up – no wonder urban markets are on fire, while suburban houses and rural second homes are sluggish.

What does this mean in a global context?

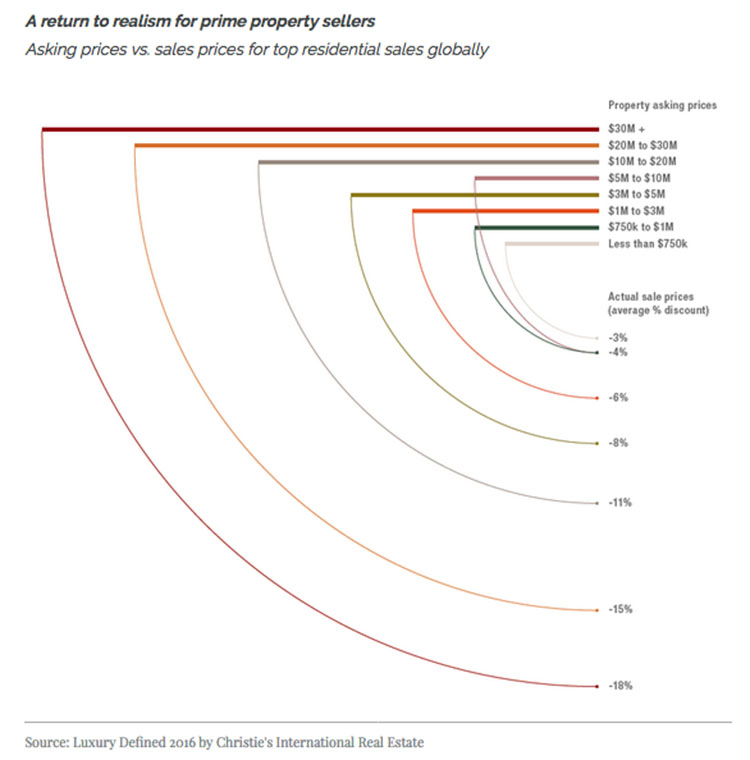

Christie’s publishes an annual Luxury Defined white paper. This year’s edition focused on the “New Realism” of the luxury market. Key messages are:

- Prices of prime properties are set by location, features, size, rarity, provenance and—most importantly— by supply and demand conditions that determine what the market will bear.

- Today’s new luxury landscape is increasingly a tale of misaligned expectations, characterized by a widening disparity between what buyers and sellers consider fair market value for prestige properties.

Given the gap in experience between boomers and Gen Xers, and the weight of boomers selling vs. Gen Xers selling, this makes sense.

What to do?

Take the advice of the best in the business. Again, from the white paper:

|

For the full white paper, click here. For expert guidance on how to navigate today’s challenging real estate environment, contact Ruth Kennedy Sudduth, Director, Residential Brokerage Division.